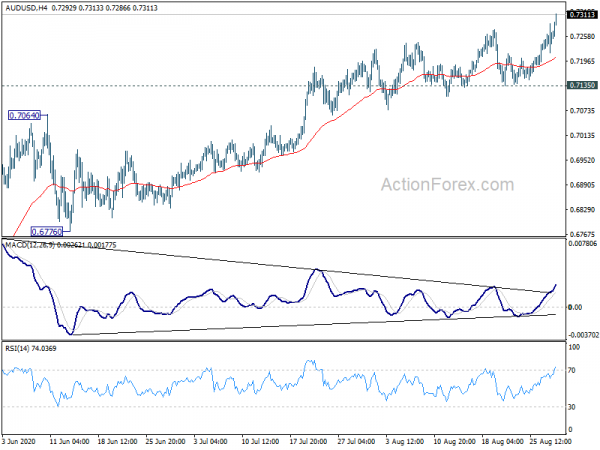

Daily Pivots: (S1) 0.7219; (P) 0.7255; (R1) 0.7292; More…

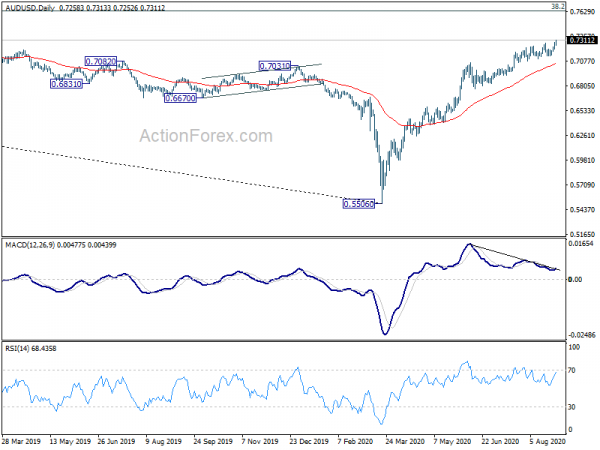

AUD/USD’s break of 0.7275 confirms resumption of whole rise from 0.5506. Intraday bias is back on the upside, with focus on 0.7311 long term EMA. Sustained trading above there will pave the way to 0.7635 fibonacci level. On the downside, break of 0.7135 support should indicate short term topping and bring correction.

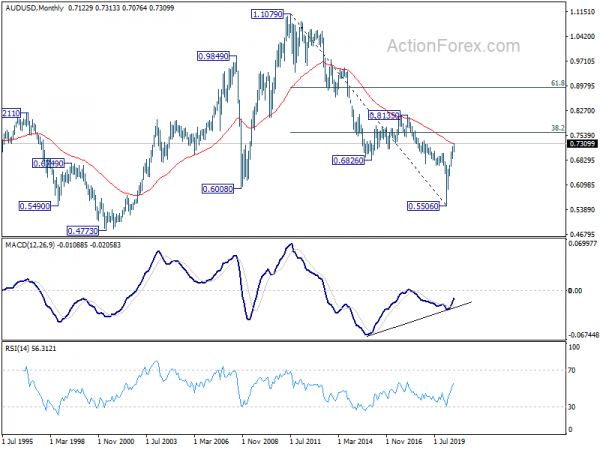

In the bigger picture, rebound from 0.5506 medium term bottom could be correcting whole long term down trend from 1.1079 (2011 high). Further rally would be seen to 55 month EMA (now at 0.7311). Firm break there will target 38.2% retracement of 1.1079 (2011 high) to 0.5506 (2020 low) at 0.7635. This will remain the preferred case as long as it stays above 55 week EMA (now at 0.6853). However, sustained trading below 55 week EMA will turn focus back to 0.5506 low instead.