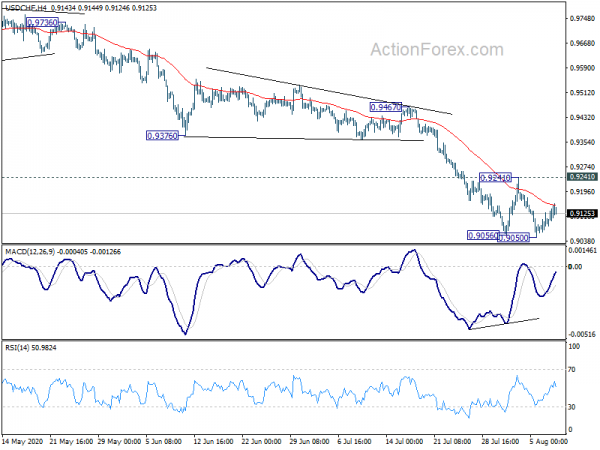

USD/CHF edged lower to 0.9050 last week but quickly recovered. Initial bias remains neutral this week and further fall is in favor as long as 0.9241 resistance holds. Break of 0.9050 will resume larger down trend. Though, break of of 0.9241 will confirm short term bottoming and turn bias to the upside for 0.9376 support turned resistance.

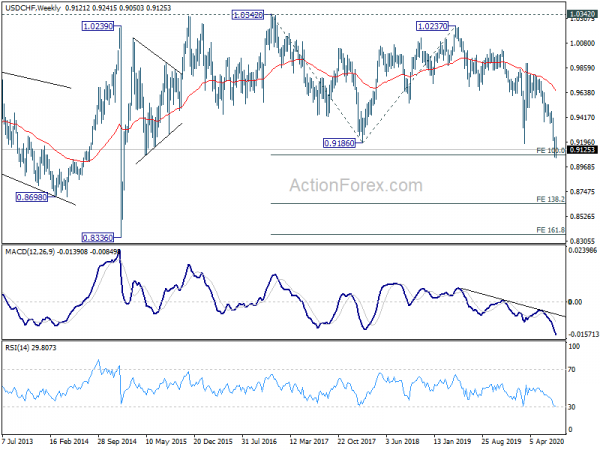

In the bigger picture, decline from 1.0237 is seen as the third leg of the pattern from 1.0342 (2016 low). Current development suggests that such pattern is still extending. Sustain trading below 100% projection of 1.0342 to 0.9186 from 1.0237 at 0.9081 will pave the way to 138.2% projection at 0.8639. On the upside, break of 0.9376 resistance is needed to be the first sign of medium term bottoming.

In the long term picture, price actions from 0.7065 (2011 low) are not clearly impulsive yet. Thus, we’ll treat it as developing into a corrective pattern, at least, until a firm break of 1.0342 resistance.