Sterling tumbles sharply as markets perceive BoE announce as a rather dovish one. BoE left monetary policy unchanged at widely expected. Bank rate is held at 0.25% and asset purchase target at GBP 435b. The rate decision came with 6-2 vote as generally expected. Ian McCafferty and Michael Saunders maintained their push for a 25bps hike. Chief economist Andy Haldane, who sounded hawkish recently, didn’t vote for a hike. New comer Silvana Tenreyro didn’t follow her predecessor Kristin Forbes and, voted for unchanged.

In the latest forecast, BoE continued to assume "smooth" Brexit and a rate hike by Q3 of 2018. Growth is now projected to be 1.7% in 2017 and 1.6% in 2018. Both were revised down from prior projection of 1.9% and 1.7% respectively. 2019 growth forecast was held unchanged at 1.8%.

Inflation forecast was unchanged except for 2017. Looking at the details, inflation is forecast to average 2.7% in 2017, 2.6% in 2018, 2.2% in 2019. That compare to prior forecast of 2.6% in 2017, 2.6% in 2018 and 2.2% in 2019. That is largely unchanged. Overall, inflation is projected to peak at around 3% in October and then slow back to 2.2% in 2020.

Overall, the announcement came out on the dovish side. Haldane didn’t deliver. Tenreyro is not a hawk. Growth is revised down. Inflation is projection is largely unchanged meaning that BoE still believe the surge in inflation earlier this year is temporary. And recent calls for hike were seen as more being nervous than anything.

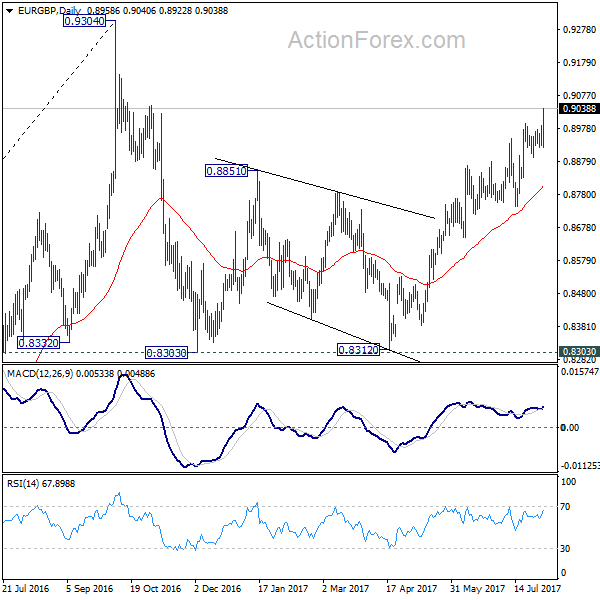

Technically, EUR/GBP powers through 0.8994 and is resuming it’s rally to 0.9304 high. GBP/USD is having is sight back on 1.3 handle. GBP/JPY is heading back to 144 support.

UK PMI services surprised to the upside

UK PMI services rose to 53.8 in July, up from 53.4, above expectation of 53.6. Markit noted that taken together with rise in manufacturing PMI in the same month, UK economy is growing at a "steady but sluggish" quarter of 0.3% in Q3. It also noted that companies face a "relentless burden of inflationary cost pressures" on Sterling’s depreciation since the Brexit referendum. Markit chief business economist Chris Williamson warned that "while the current picture remained one of an economy showing overall resilience in the face of concerns about the outlook, the subdued level of business optimism suggests it’s likely that growth will at least remain modest and could easily weaken in coming months."

ECB: Wage and consumer goods price drag inflation

ECB noted in the monthly bulletin that wages and price of consumer goods growth are still slow and are holding inflation back in general. It noted that years of low inflation environment are dragging down wage growth. Also, there is still "significant slack in the labor market, weak productivity growth and the ongoing impact of labor market reforms". While foreign price pressure are spreading into Eurozone, "underlying domestic price pressures remain subdued."

From Eurozone, retail sales rose 0.5% mom, 3.1% yoy in June, much better than expectation of 0.0% mom, 2.5% yoy. Eurozone PMI services was finalized at 55.4, unrevised. France PMI services was revised up by 0.1 to 56.0. Germany PMI services was revised down by 0.4 to 53.1. Italy services PMI rose to 56.3 in July, up from 53.6, much stronger than expectation of 54.1.

US-China relations turns sour

On the geopolitical front, US President Donald Trump has become less patient over China’s actions, of lack of actions, towards North Korea, a hermit kingdom that has been growing provocative with it missile tests. Trump and China’s President Xi Jinping agreed back in May that the latter would increase diplomatic and economic pressure over North Korea, in an attempt to denuclearize the country. However, little effect has been seen so far and North Korea even had two successful tests of ICBM missile over the past month. A CNN report revealed that revised military options for North Korea have been prepared by the US though diplomatic engagement is still preferred.

US-China trade relations have soured since July and it was reported that the US has been preparing broad trade case against China. We believe the triggering point is China’s reluctance to confront North Korea over nuclear weapons. Indeed, Trump, since his inauguration in January, has linked US-China trade relations to the North Korean problem. Staying in Asia, China claims India pulled out most troops from Doklam in India and Donglang in China, the tri-junction border shared by China, India, and Bhutan. The standoff has entered its seventh week and neither side appears ready for a war or a compromise.

More in US-North Korea-China Triangle: Intimidation Unlikely to Turn into War.

Elsewhere

US initial jobless claims dropped 5k to 240k in the week ended July 29. Continuing claims rose 3k to 1.96m in the week ended July 22. Australia trade surplus narrowed to 0.86b in June. New Zealand ANZ commodity price dropped -0.8% in July. China Caixin PMI services dropped 0.1 to 51.5 in July.

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8933; (P) 0.8961; (R1) 0.8991; More

EUR/GBP’s rally resumed by taking out 0.8994 firmly and reaches as high as 0.9040 so far. Intraday bias is back on the upside. Current rally from 0.8312 is now extending to 0.9304 key resistance level. At this point, there is no clear sign of up trend resumption yet. Hence, we’ll be cautious on strong resistance from 0.9304 to limit upside and bring another fall. However, break of 0.8922 support is needed to be the first sign of short term topping. Otherwise, outlook will remain bullish in case of retreat.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s uncertain whether it is finished yet. But in case of another fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:00 | NZD | ANZ Commodity Price Jul | -0.80% | 2.10% | ||

| 01:30 | AUD | Trade Balance (AUD) Jun | 0.86B | 1.77B | 2.47B | 2.02B |

| 01:45 | CNY | Caixin China PMI Services Jul | 51.5 | 51.9 | 51.6 | |

| 07:45 | EUR | Italy Services PMI Jul | 56.3 | 54.1 | 53.6 | |

| 07:50 | EUR | France Services PMI Jul F | 56 | 55.9 | 55.9 | |

| 07:55 | EUR | Germany Services PMI Jul F | 53.1 | 53.5 | 53.5 | |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:00 | EUR | Eurozone Services PMI Jul F | 55.4 | 55.4 | 55.4 | |

| 08:30 | GBP | Services PMI Jul | 53.8 | 53.6 | 53.4 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Jun | 0.50% | 0.00% | 0.40% | |

| 09:00 | EUR | Eurozone Retail Sales Y/Y Jun | 3.10% | 2.50% | 2.60% | 2.40% |

| 11:00 | GBP | BoE Rate Decision | 0.25% | 0.25% | 0.25% | |

| 11:00 | GBP | BoE Asset Purchase Target | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 2–0–6 | 2–0–6 | 3–0–5 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–8 | 0–0–8 | 0–0–8 | |

| 11:00 | GBP | BoE Inflation Report | ||||

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | -37.60% | -19.30% | ||

| 12:30 | USD | Initial Jobless Claims (JUL 29) | 240K | 242K | 244K | 245K |

| 14:00 | USD | ISM Non-Manufacturing Composite Jul | 56.9 | 57.4 | ||

| 14:00 | USD | Factory Orders Jun | 2.80% | -0.80% | ||

| 14:30 | USD | Natural Gas Storage | 17B |