The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.17986

Open: 1.18595

% chg. over the last day: +0.52

Day’s range: 1.18595 – 1.19162

52 wk range: 1.0777 – 1.1781

The greenback has continued to lose ground before Friday’s US labor market report for July. EUR/USD quotes have reached the round level of 1.1900 again. The 1.1845 mark is the nearest support. The US published ambiguous economic releases. At the moment, financial market participants expect additional drivers. A technical correction is possible in the near future. Positions should be opened from key levels.

The news feed on 2020.08.06:

Initial jobless claims in the US at 15:30 (GMT+3:00).

Indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy EUR/USD.

Stochastic Oscillator is in the neutral zone, the %K line has started crossing the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.1845, 1.1800, 1.1740

Resistance levels: 1.1900, 1.1950

If the price fixes below 1.1845, EUR/USD quotes are expected to correct. The movement is tending to 1.1800-1.1760.

An alternative could be the growth of the EUR/USD currency pair to 1.1940-1.1960.

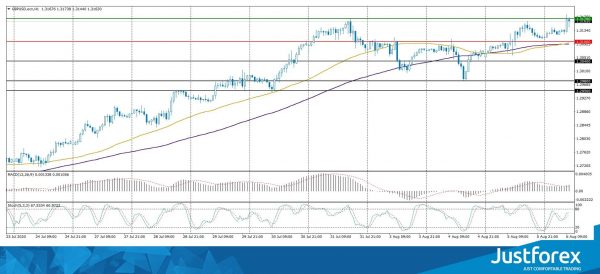

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.30528

Open: 1.31120

% chg. over the last day: +0.40

Day’s range: 1.31114 – 1.31833

52 wk range: 1.1466 – 1.3516

Purchases still prevail on the GBP/USD currency pair. The British pound has reached key highs. GBP/USD quotes are testing resistance at 1.3170. The round level of 1.3100 is already a “mirror” support. A technical correction is possible in the near future. The Bank of England, as expected, kept the key marks of monetary policy at the same level. Positions should be opened from key levels.

We recommend paying attention to the news feed from the US.

Indicators point to the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, which indicates the bullish sentiment.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which also gives a signal to buy GBP/USD.

Trading recommendations

Support levels: 1.3100, 1.3040, 1.2980

Resistance levels: 1.3170

If the price fixes below 1.3100, GBP/USD quotes are expected to correct. The movement is tending to 1.3050-1.3000.

An alternative could be a further growth of the GBP/USD currency pair to 1.3220-1.3250.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.33182

Open: 1.32660

% chg. over the last day: -0.40

Day’s range: 1.32438 – 1.32867

52 wk range: 1.2949 – 1.4668

The USD/CAD currency pair has become stable after a prolonged fall. At the moment, the loonie is being traded in a flat. The key support and resistance levels are 1.3240 and 1.3290, respectively. A technical correction of the trading instrument is possible in the near future. We recommend paying attention to the dynamics of oil prices. Positions should be opened from key levels.

The news feed on Canada’s economy is calm.

Indicators signal the power of sellers: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell USD/CAD.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the development of a correction movement.

Trading recommendations

Support levels: 1.3240, 1.3200

Resistance levels: 1.3290, 1.3335, 1.3360

If the price fixes below 1.3240, a further drop in USD/CAD quotes is expected. The movement is tending to the round level of 1.3200.

An alternative could be the growth of the USD/CAD currency pair to 1.3330-1.3350.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 105.710

Open: 105.520

% chg. over the last day: -0.13

Day’s range: 105.390 – 105.644

52 wk range: 101.19 – 112.41

The USD/JPY currency pair continues to consolidate. There is no defined trend. The trading instrument is testing the following key support and resistance levels: 105.30 and 105.80, respectively. Financial market participants expect additional drivers. We recommend paying attention to the dynamics of US government bonds yield. Positions should be opened from key levels.

The news feed on Japan’s economy is calm.

Indicators do not give accurate signals: 50 MA has crossed 100 MA.

The MACD histogram is near the 0 mark. There are no signals at the moment.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 105.30, 104.80, 104.20

Resistance levels: 105.80, 106.20, 106.45

If the price fixes above 105.80, further growth of USD/JPY quotes is expected. The movement is tending to 106.20-106.50.

An alternative could be a decline in the USD/JPY currency pair to 105.00-104.80.