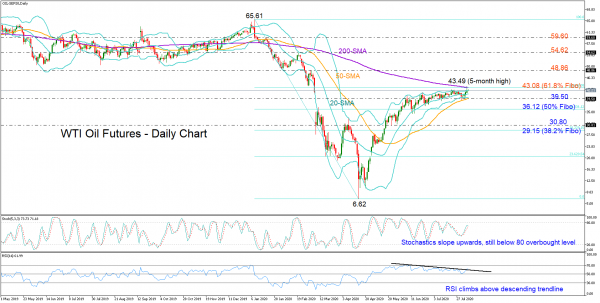

WTI oil futures for September delivery stabilized near the 200-day simple moving average (SMA) and around the 61.8% Fibonacci retracement of the 65.61-6.62 downleg after unlocking a five-month high of 43.49.

Oil has been printing higher highs and higher lows since the plunge to a record low of 6.62, though the uptrend lost shine from June onwards, raising some worries about its sustainability.

Meanwhile, Bollinger bands have narrowed significantly, foreshadowing a more volatile session, with momentum indicators currently suggesting that this could be a positive rather a negative one. The RSI is sloping upwards and is set to cross above a descending trendline, while the Stochastics are also pointing upwards but have yet to reach overbought levels.

A decisive close above the 200-day SMA (43.00) could trigger a steeper upside correction likely towards the March peak of 48.86. Heading higher, the bullish action may next pause near the 54.62 barrier before extending to the 59.60.

Alternatively, the bears could take full control if the price drops below the supportive 50-day SMA at 39.50, likely leading the market towards the 50% Fibonacci of 36.12. Failure to hold above that point could generate a sharper decline that may stall somewhere between the 30.80 obstacle and the 38.2% Fibonacci of 29.15.

Summarizing, WTI oil futures seem ready to stage a new move. A break above 43.00 is expected to favor the bulls, while a fall below 39.50 could give the lead to the bears.