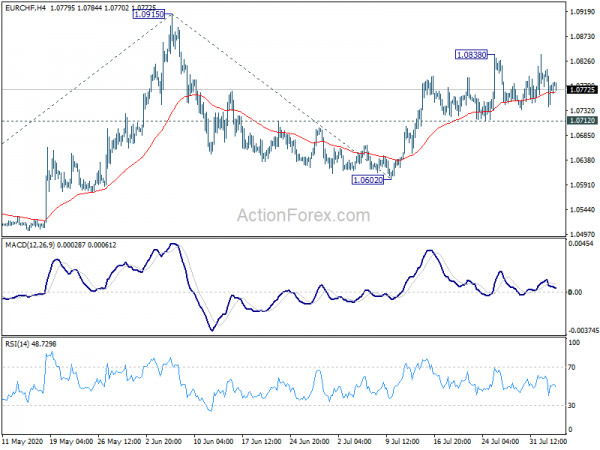

Daily Pivots: (S1) 1.0742; (P) 1.0776; (R1) 1.0813; More…

Intraday bias in EUR/CHF remains neutral and more sideway consolidation could be seen. On the upside, break of 1.0838 will target 1.0915 high. Firm break there will resume whole rise from 1.0503 to 100% projection of 1.0503 to 1.0915 from 1.0602 at 1.1014 next. However, break of 1.0712 support will dampen this bullish view. Intraday bias will be turned back to the downside for 1.0602, to extend the corrective pattern from 1.0915 instead.

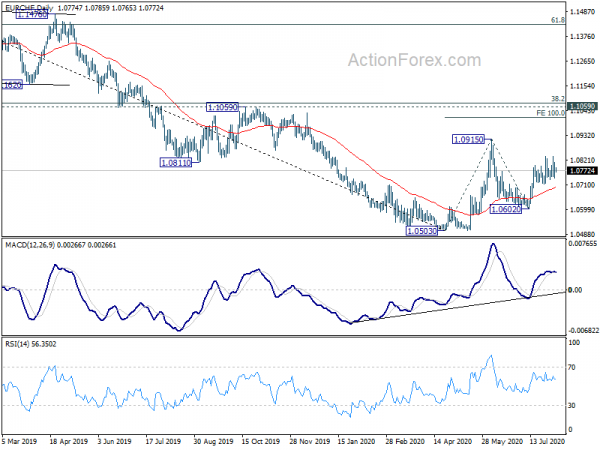

In the bigger picture, as long as 1.1059 cluster resistance (38.2% retracement of 1.2004 to 1.0503 at 1.1076) holds, price actions from 1.0503 are seen as a consolidation pattern. That is, down trend from 1.2004 (2018 high) would still extend through 1.0503 low at a later stage. However, sustained break of 1.1059/76 will argue that rise from 1.0503 is starting a new up trend and would target 61.8% retracement at 1.1431 and above.