Canada will publish its retail sales data for the month of May at 1230 GMT on Tuesday before releasing inflation figures of June at the same time on Wednesday. Given its sharp tumble in the preceding month, the retail sales report could be a more important market mover among data releases for the loonie this week, which has just managed to stabilize from last month’s sell-off.

Why the Bank of Canada is avoiding a rate cut

The Bank of Canada (BoC) kept its interest rates unchanged at the last meeting on June 15 and policymakers noted that rates will remain at 0.25% until the 2% inflation target has been achieved. Much like the rest of the world, Canada’s economy has been crippled by the pandemic and the ensuing lockdown, as tens of thousands of people have been sickened by Covid-19 in parts of Canada’s largest cities.

The Committee mentioned that the economy is in a recovery mode amid the easing of coronavirus restrictions, though the outlook is still uncertain due to the unpredictable pandemic. Also, policymakers referred to their quantitative easing program that will continue with large-scale asset purchases and forecasted that the real GDP will likely dive by 7.8% in 2020 and expand again with growth of 5.1% in 2021 and 3.7% in 2022.

Retail sales to rebound after tumble

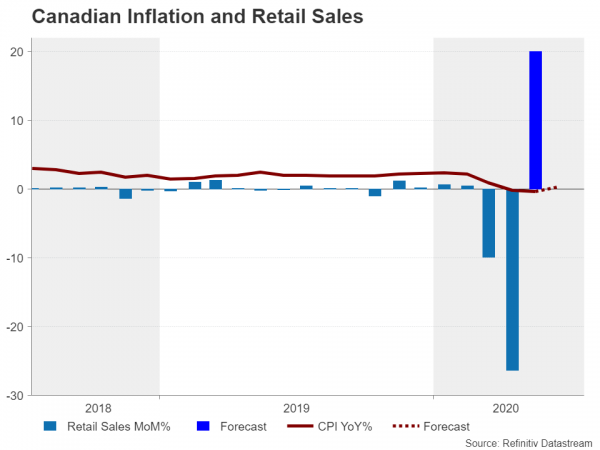

Retail sales in Canada tumbled by 26.4% m/m in April, which was the largest downturn on record due to the Covid-19 pandemic and is expected to have rebounded to 20% m/m in May. Core sales are predicted to increase by 12% m/m versus a decline of 22% m/m previously. The falls were mainly led by the significant drop at motor vehicle and parts dealers, clothing and clothing accessories stores and gasoline stations, as crude oil prices collapsed due to a global oil supply glut and lower demand.

Inflation to hold below the target

This week, the headline CPI inflation may not urge any change in interest rates once again as the index is forecasted to rebound to 0.2% y/y from -0.4% previously, holding well below the 2.0% midpoint target for another month. The core CPI inflation is predicted to inch up to 0.9% y/y from 0.7% before.

Technical view on loonie

In terms of market reaction, traders are more interested about this months’ retail sales data. Hence, for the loonie, if the numbers beat expectations, they could bolster the currency, pushing the dollar/loonie pair even lower.

Otherwise, a weaker inflation prints especially in the core measures, which better reflect the inflation trend, could ease momentum in the market as investors wait and see whether there will be any further deterioration in global economic conditions and therefore in the Canadian GDP growth probably stemming from the coronavirus.

Looking at USDCAD, the price is in a neutral mode over the last six weeks and is pushing efforts to continue the four-month downside move, bringing support around the 200-day SMA and the 1.3483 barrier. Lower, the price could retest the 1.3310 region before heading to the 1.3200 psychological mark.

Alternatively, disappointing CPI and retail sales numbers could re-challenge nearby resistance around 1.3715, above the short-term moving averages. Beyond that obstacle, the way would open towards the 1.3850 level and then up to 1.4050.