Key Highlights

- USD/JPY found a strong support near the 106.65 level.

- A crucial bearish trend line is forming with resistance near 107.25 on the 4-hours chart.

- The US Initial Jobless Claims in the week ending July 11, 2020 declined from 1,310K to 1,300K.

- The Euro Zone CPI is likely to increase 0.3% in June 2020 (MoM), similar to the last reading.

USD/JPY Technical Analysis

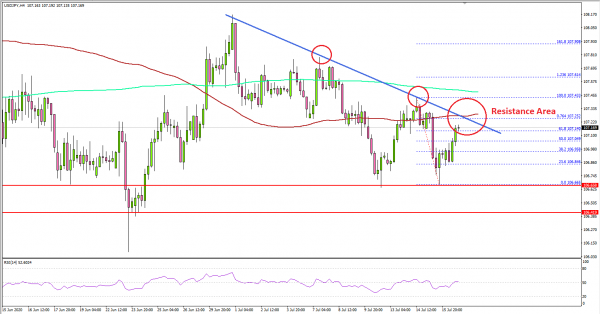

This week, the US Dollar extended its decline below 107.00 against the Japanese Yen. USD/JPY retested the key 106.65 support and it is currently attempting a strong recovery.

Looking at the 4-hours chart, the pair traded as low as 106.66 and recovered above the 106.80 level. It surpassed the 50% Fib retracement level of the downward move from the 107.43 high to 106.66 low.

On the upside, the pair seems to be facing a strong resistance near the 107.25 level and the 100 simple moving average (red, 4-hours). There is also a crucial bearish trend line forming with resistance near 107.25 on the same chart.

The trend line is close to the 76.4% Fib retracement level of the downward move from the 107.43 high to 106.66 low. If there is a clear break above the trend line, the pair could attempt to clear the 107.50 resistance and the 200 simple moving average (green, 4-hours).

Conversely, there is a risk of a sharp decline below the 106.65 and 106.40 support levels. In the stated scenario, the pair may perhaps revisit the 106.00 support.

Fundamentally, the US Initial Jobless Claims figure in the week ending July 11, 2020 was released yesterday by the US Department of Labor. The market was looking for a decline in claims from 1,314K to 1,250K.

The result was below the market forecast, as the US Initial Jobless Claims came in at 1,300K. The last reading was revised down from 1,314K to 1,310K.

The report added:

The advance number for seasonally adjusted insured unemployment during the week ending July 4 was 17,338,000, a decrease of 422,000 from the previous week’s revised level.

Overall, USD/JPY could start a strong recovery if it clears 107.25 and 107.50. Looking at EUR/USD, the pair tested the 1.1450 region before correcting lower.

Upcoming Economic Releases

- Euro Zone CPI June 2020 (YoY) – Forecast +0.3%, versus -0.1% previous.

- Euro Zone CPI June 2020 (MoM) – Forecast +0.3%, versus +0.3% previous.