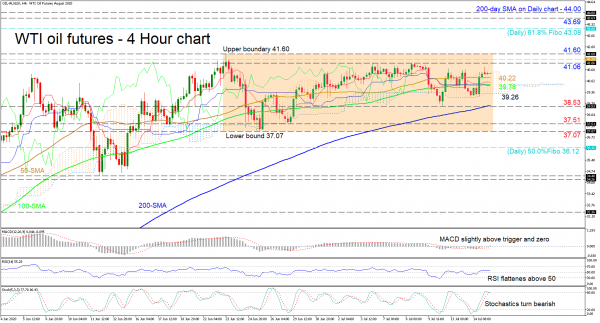

WTI oil futures slid into a range structure from 37.07 – 41.60, following a one-and-a-half-month ascent from 6.62. The commodity is holding above the 200-period simple moving average (SMA) but was unable to close above the 41.28 key upper level of a gap in March.

The gradual levelling in the 50- and 100-period SMAs as well as the steadying of the Ichimoku lines and cloud, further aids the consolidation in the price. The technical oscillators reflect a pause in positive momentum. The MACD has inched above its red trigger line and zero mark, while the RSI hovers above its neutral threshold. Yet, the stochastic oscillator has turned bearish at 80, suggesting weakness in advances.

Pushing off the cloud’s upper surface, initial friction may arise from the 41.06 highs. Should the commodity overcome the essential 41.28 resistance and the 41.60 ceiling of the range, it may rise towards the 43.08 level, that being the 61.8% Fibonacci retracement of the down leg from 65.61 to 6.62 on the daily chart. Additional gains may then tackle the critical 43.69 inside swing low of March 2 before the 200-day SMA at 44.00, displayed on the daily chart.

Alternatively, if sellers steer below the nearby 50- and 100-period SMAs at 40.22 and 39.78, the lower band of the cloud at 39.26 may interrupt the drop towards the 38.53 low, where the 200-period SMA lies. Diving under this may challenge the 37.51 trough and the floor of the consolidation at 37.07. Weakening further, the commodity may target the 50.0% Fibo of 36.12 from the daily chart.

Overall, the short-term picture maintains a positive tone above the 200-period SMA. A break above 41.60 may strengthen the positive picture while a break above 43.69 may repower the broader bullish outlook.