BoJ left monetary policy unchanged as widely expected. Under the Yield Curve Control framework, short term policy interest rate is held at -0.1%. BoJ will also continue to purchase unlimited JGBs to keep 10-year yield at around 0%. It maintained the pledge to continue with QQE “as long as it is necessary” for achieving 2% price target in a stable manner. The decision was made by 8-1 vote, as Kataoka Goushi dissented again, pushing for more stimulus by lowering short and long term interest rates. He also pushed for revising the forward guidance to relate it to price stability target.

In the Outlook for Economic Activity and Prices, BoJ said the economy is “likely to improve gradually from the second half of this year” But the pace is expected to be “only moderate while the impact of the novel coronavirus remains worldwide”. Year-on-year CPI less fresh food is “likely to be negative for the time being”. The projected growth rates and projected CPI in the report are “broadly within the range” or prior forecasts. Nevertheless, outlook is “extremely unclear” with risks “skewed to the downside”.

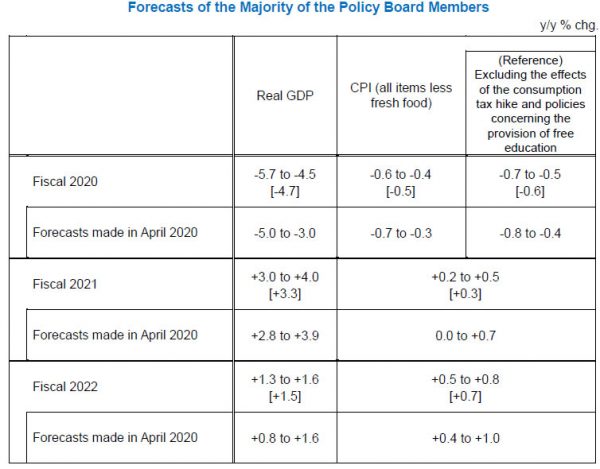

In the new forecasts:

- GDP to contract -5.7% to -4.5% in fiscal 2020 (versus prior -5.0% to -3.0%).

- GDP to grow 3.0% to 4.0% in fiscal 2021 (vs prior 2.8% to 3.9%).

- GDP to growth to grow 1.3% to 1.6% in fiscal 2022 (vs prior 0.8% to 1.6%).

- Core CPI at -0.6% to 0.4% in fiscal 2020 (vs prior -0.7% to -0.3%).

- Core CPI at 0.2% to 0.5% in fiscal 2021 (vs prior 0.0% to 0.7%).

- Core CPI at 0.5% to 0.8% in fiscal 2022 (vs prior 0.4% to 1.0%).