Dollar suffered another round of selloff against Euro, Sterling and Yen yesterday as the political drama in White House continued. Australian Dollar jumps earlier today as lifted by better than expected data from China. But there is no follow through buying after RBA stands pat and warns of recent appreciation in the exchange rate. Sterling is also trading mildly higher as markets await UK manufacturing data. Euro also stays strong ahead of Q2 GDP. WTI oil price surged through 50 handle overnight but provides little boost to Canadian Dollar, as USD/CAD is struggling in tight range around 1.2460 key support level.

RBA Maintained Status Quo, Warned that Strong Aussie is Curbing Growth

As widely anticipated, the RBA left the cash rate unchanged at 1.5%. Policymakers acknowledged that June inflation drifted back below the +2% target but remained confident it would improve gradually alongside the pickup of the economy. Policymakers, however, warned of Australian dollar’s appreciation, suggesting that it would limit economic growth. A reference of the negative impact of strong currency on economic developments reappeared as AUDUSD has risen +5.7% from July’s low of 0.7567. More in RBA Maintained Status Quo, Warned that Strong Aussie is Curbing Growth

Fed Vice Fischer: Political and economy uncertainty is dragging growth

Fed Vice Chair Stanley Fischer warned that political and economy uncertainty is dragging growth in the US and globally. He said that "uncertainty about the outlook for government policy in health care, regulation, taxes, and trade can cause firms to delay projects until the policy environment clarifies." While US President Donald Trump always talks about bring the economy to above 3% growth, Fisher noted that the Congressional Budget Office estimates that growth potential is closer to 1.5%. And he said that "lower growth diminishes the number of business opportunities that can be profitably undertaken."

Talking about political uncertainty US, Trump’s new chief of staff John Kelly just forced Anthony Scaramucci out of the post of White House Communications Director after 10 days of the latter’s appointment. Press secretary said in a statement that "Mr. Scaramucci felt it was best to give Chief of Staff John Kelly a clean slate and the ability to build his own team." Politics aside, the better news yesterday was that Gary Cohn, Trump’s top economic adviser, said "the number one topic of the Cabinet meeting today was talking about taxes, tax reform, what it would take to get tax reform done this year."

UK Chancellor Hammond: Brexit "won’t be postponed or delayed"

In UK, there are talks the deadline of Brexit could slip due to lack of progress in the negotiation with EU so far. But Chancellor of the Exchequer Philip Hammond emphasized that Brexit "won’t be postponed or delayed". Hammond noted that "There is a discussion going on about how we will then move from full membership of the European Union to a future relationship with the European Union. That is a debate, a discussion that will go on through these negotiations." Trade Secretary Liam Fox was also firm and said "we will leave the European Union at the end of March 2019… there’s no doubt about it."

Prime Minister Theresa May confirmed that freedom of movement will end on the date Brexit takes effect in March 2019. Her spokesman said that "the Prime Minister’s position on an implementation period is very clear and well-known… Free movement will end in March 2019. We have published proposals on citizens’ rights".

Oil surges through 50

WTI crude oil surged through 50 handle overnight and is staying firm above. A factor boosting oil prices was US sanction over Venezuela president Nicolas Maduro after an election over the weekend virtually gave the president unlimited power. Threat of US sanctions against Venezuela added to hopes of tightening supply. Also, there’s some optimism on the OPEC/non-OPEC technical meeting discuss about the compliance issue. As the OPEC statement suggested, the meeting aims to "better understand the difficulties and obstacles faced by some OPEC and non-OPEC participating countries and to assess how conformity levels can be improved with the goal of achieving a faster rebalanced global oil market, for the benefit of producers and consumers alike".

On the data front

China Caixin PMI manufacturing rose to 51.1 in July, up from 50.4, and beat expectation of 50.4. It’s noted in the statement that "panelists widely commented on an improvement in market conditions and strong foreign demand. Notably, new export sales increased at the second-fastest rate since September 2014." New export orders jumped sharply from 50.9 to 53.5, hitting the highest level since February.

Looking ahead, Eurozone Q2 GDP and UK PMI manufacturing will be the main focuses in European session. Later in the day, US personal income and spending, ISM manufacturing will catch most attention.

AUD/USD Daily Outlook

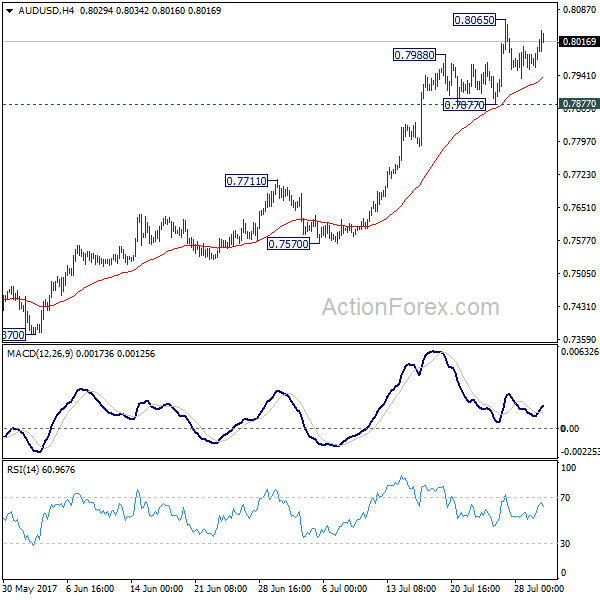

Daily Pivots: (S1) 0.7946; (P) 0.7976; (R1) 0.8016; More…

AUD/USD recovers today but stays in range of 0.7877/8065. Intraday bias remains neutral for the moment. Another rally is expected as long as 0.7877 support holds. Break of 0.8065 will target 100% projection of 0.6826 to 0.7833 from 0.7328 at 0.8335. Nonetheless, break of 0.7877 will indicate short term topping, possibly with bearish divergence condition in 4 hour MACD. In such case, intraday bias will be turned back to the downside for 0.7711 resistance turned support.

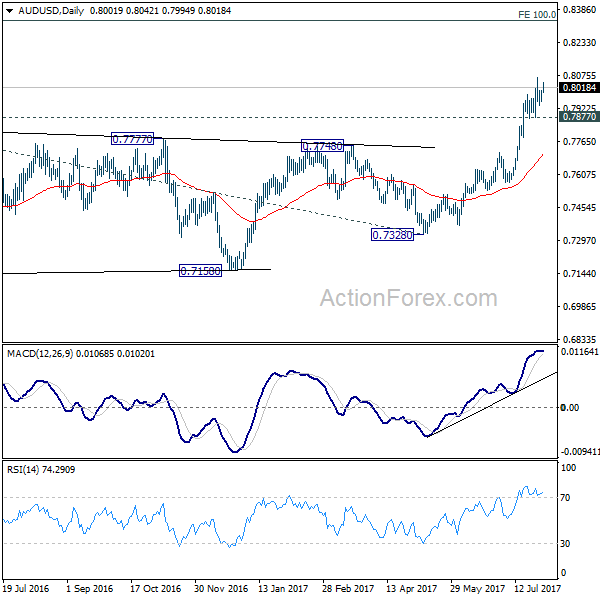

In the bigger picture, current development suggests that rebound from 0.6826 is developing into a medium term rise. There is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, further rise is now expected to 55 month EMA (now at 0.8100) or even further to 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7328 support is needed to confirm completion of the rebound. Otherwise, further rise is now expected.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | JPY | PMI Manufacturing Jul F | 52.1 | 52.2 | 52.2 | |

| 1:45 | CNY | Caixin PMI Manufacturing Jul | 51.1 | 50.4 | 50.4 | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 6:00 | GBP | Nationwide House Prices M/M Jul | -0.10% | 1.10% | ||

| 7:45 | EUR | Italy Manufacturing PMI Jul | 55.1 | 55.2 | ||

| 7:50 | EUR | France Manufacturing PMI Jul F | 55.4 | 55.4 | ||

| 7:55 | EUR | Germany Manufacturing PMI Jul F | 58.3 | 58.3 | ||

| 7:55 | EUR | German Unemployment Change Jul | -5k | 7k | ||

| 7:55 | EUR | German Unemployment Rate Jul | 5.70% | 5.70% | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Jul F | 56.8 | 56.8 | ||

| 8:30 | GBP | PMI Manufacturing Jul | 54.5 | 54.3 | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q2 A | 0.60% | 0.60% | ||

| 12:30 | USD | Personal Income Jun | 0.40% | 0.40% | ||

| 12:30 | USD | Personal Spending Jun | 0.10% | 0.10% | ||

| 12:30 | USD | PCE Deflator M/M Jun | 0.00% | -0.10% | ||

| 12:30 | USD | PCE Deflator Y/Y Jun | 1.30% | 1.40% | ||

| 12:30 | USD | PCE Core M/M Jun | 0.10% | 0.10% | ||

| 12:30 | USD | PCE Core Y/Y Jun | 1.40% | 1.40% | ||

| 14:00 | USD | ISM Manufacturing Jul | 56.4 | 57.8 | ||

| 14:00 | USD | ISM Prices Paid Jul | 56.5 | 55 | ||

| 14:00 | USD | Construction Spending M/M Jun | 0.50% | 0.00% |