Yen and Dollar trade mildly firmer today as markets are staying consolidation mode ahead of the key events ahead, including RBA, BoE and US NFP. Economic data from Eurozone are positive but provide little inspiration to the common currency. Meanwhile, commodity currencies are trading generally lower even though WTI crude oil extends recent rise and breaches 50 handle briefly. Released from Canada, IPPI dropped -0.1% mom in June, below expectation of -0.3% mom. RMPI dropped -3.7% mom, below expectation of -2.2% mom.

Eurozone core inflation jumped to four year high

Eurozone headline CPI was unchanged at 1.3% yoy in July, in line with consensus. Meanwhile, core CPI unexpected ticked up by 0.1% to 1.2% yoy. That’s the highest reading in four years since August 2013. Unemployment rate dropped to 9.1%, lowest since 2009. The data continued to paint a positive picture for the Eurozone. And that also affirm the view that ECB will at least announce tapering of asset purchases of some sort in September, or by latest October. ECB President Mario Draghi also indicated that QE discussion would begin in autumn. Also from Eurozone, German retail sales rose strongly by 1.1% mom in June, well above expectation of 0.2% mom.

ECB governing council member Sabine Lautenschlaeger said in a newspaper remarks that "the expansionary monetary policy has both advantages and side effects. As time passes, the positive effects get weaker and the risks increase." And, she urged that "it’s important to prepare for the exit in good time." But she noted that "what’s crucial in that context is a stable trend in the rate of inflation towards our objective of just under 2 percent. It’s not quite there yet."

UK mortgage approvals dropped slightly

UK mortgage approvals dropped from 65.11k to 64.70k in June, indicating that lenders have approved fewest mortgages since last September. M4 money supply dropped -0.2% mom, below expectation of 0.2% mom rise. There are a number of interesting points to watch in the upcoming BoE Super Thursdays. One of the three MPC members who voted for a hike, Kristin Forbes, has left. It’s uncertain what her replace will vote for. The calls for a rate hike in response to surging inflation cooled after CPI miss. If BoE doesn’t raise it inflation forecast in the Quarterly Inflation Report, such rate hike talks will recede even quickly. Also, BoE might follow IMF and lower its own GDP forecast, which will be Sterling negative.

Released early today, official China PMI manufacturing dropped to 51.4 in July, down from 51.7 and missed expectation of 51.5. Official non-manufacturing PMI dropped to 54.5, down from 54.9. Japan industrial production rose 1.6% mom in June, housing starts rose 1.7% yoy. New Zealand building permits dropped -1.0% mom in June. Australia TD securities inflation rose 0.1% mom in July.

RBA to stand pat

The RBA meeting due tomorrow would bring no change in the monetary policy. However, the central bank’s "neutral rate" rhetoric gave Aussie a boost. At the July meeting minutes, RBA noted that neutral nominal cash rate is currently at around 3.5%, "given that medium-term inflation expectations were well anchored around 2.5%, although there is significant uncertainty around this estimate". We would like to see if policymakers do any tweak or elaboration on such reference this week. RBA’s Monetary Policy Statement due on Friday would provide update economic forecasts.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1690; (P) 1.1726 (R1) 1.1783; More…

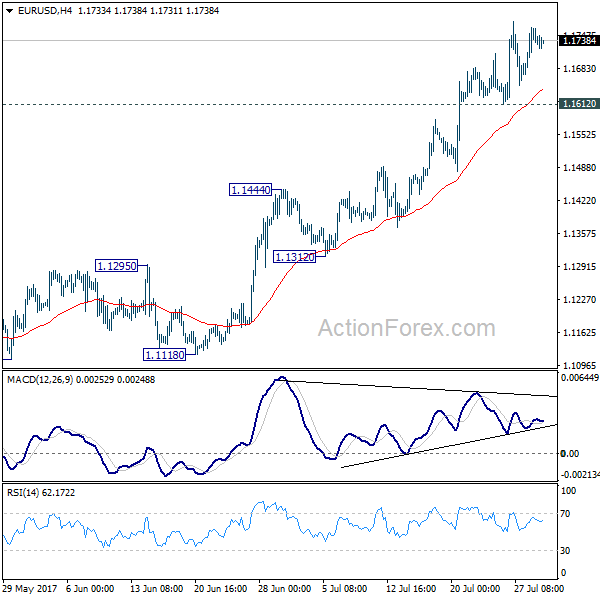

No change in EUR/USD’s outlook. With 1.1612 minor support intact, further rise is expected at this point. Whole rise from 1.0339 low is still in progress and should target 1.2 handle next. Nonetheless, considering bearish divergence condition in 4 hour MACD, break of 1.1612 will indicate short term topping and bring lengthier consolidation first.

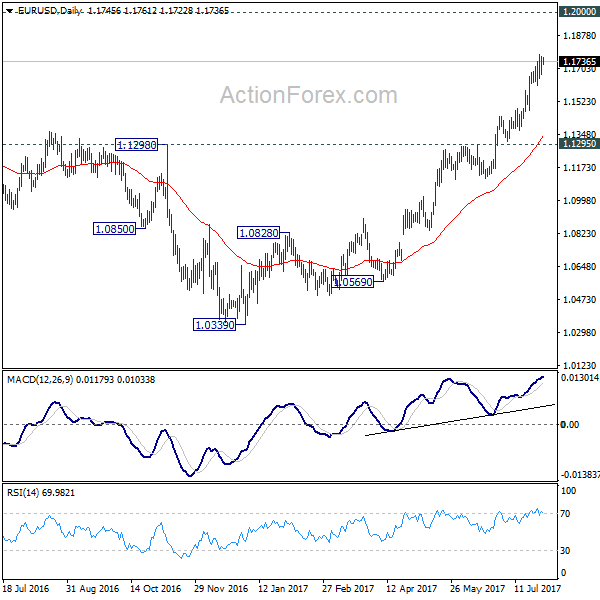

In the bigger picture, an important bottom was formed at 1.0339 on bullish convergence condition in weekly MACD. Sustained break of 55 month EMA (now at 1.1760) will pave the way to key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. While rise from 1.0339 is strong, there is no confirmation that it’s developing into a long term up trend yet. Hence, we’ll be cautious on strong resistance from 1.2516 to limit upside. But for now, medium term outlook will remain bullish as long as 1.1295 support holds, in case of pull back.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jun | -1.00% | 7.00% | 6.90% | |

| 23:50 | JPY | Industrial Production M/M Jun P | 1.60% | 1.50% | -3.60% | |

| 01:00 | AUD | TD Securities Inflation M/M Jul | 0.10% | 0.10% | ||

| 01:00 | CNY | Manufacturing PMI Jul | 51.4 | 51.5 | 51.7 | |

| 01:00 | CNY | Non-manufacturing PMI Jul | 54.5 | 54.9 | ||

| 05:00 | JPY | Housing Starts Y/Y Jun | 1.70% | 0.10% | -0.30% | |

| 06:00 | EUR | German Retail Sales M/M Jun | 1.10% | 0.20% | 0.50% | |

| 08:30 | GBP | Mortgage Approvals Jun | 65K | 65K | 65K | |

| 08:30 | GBP | M4 Money Supply M/M Jun | -0.20% | 0.20% | -0.10% | |

| 09:00 | EUR | Eurozone Unemployment Rate Jun | 9.10% | 9.20% | 9.30% | 9.20% |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Jul | 1.30% | 1.30% | 1.30% | |

| 09:00 | EUR | Eurozone CPI – Core Y/Y Jul A | 1.20% | 1.10% | 1.10% | |

| 12:30 | CAD | Industrial Product Price M/M Jun | -1.00% | -0.30% | -0.20% | 0.10% |

| 12:30 | CAD | Raw Materials Price Index M/M Jun | -3.70% | -2.20% | -1.80% | -1.70% |

| 13:45 | USD | Chicago PMI Jul | 60.8 | 65.7 | ||

| 14:00 | USD | Pending Home Sales M/M Jun | 1.00% | -0.80% |