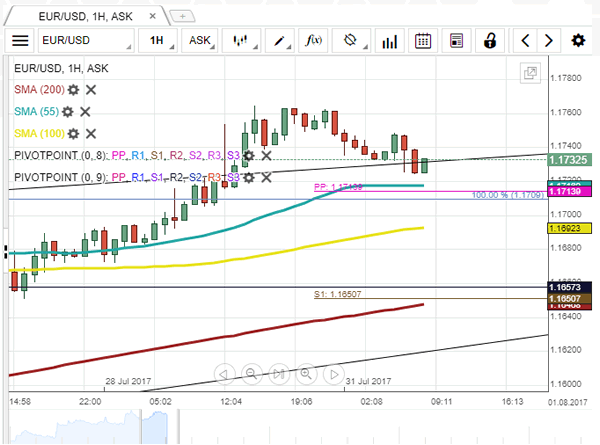

Beginning of new trading week the currency rate started above multiple technical indicators, such as the 100% Fibonacci retracement level, the updated weekly PP and the 55-hour SMA at 1.1716. To certain extent, this is a result of announcement of the US Federal Funds Rate and Advance GDP last week. Due to the fact that the road downstairs is blocked by the above combined support level, the pair has no other choice that continue to climb towards the updated weekly R1 located at the 1.1815 level. Such scenario falls in line with the rising wedge theory, whose lower support line moves along the 55- and 100-hour SMAs. If the rate reaches the above resistance level, it might give an impulse strong enough to exit the existing formation and approach the bottom boundary of the channel.