Dollar recovers mildly today but momentum has been weak. There is no change in it’s general down trend against Euro, Yen and Sterling. And, not the mention the greenback’s weakness against Canadian and Aussie. Political uncertainty in US is one of the key factors in limiting any rebound attempt in the greenback. Fed fund futures are now pricing in less than 50% chance of another rate hike by end of the year. And indeed, markets are starting to question that even if Fed does hike, the sluggish inflation outlook will keep it standing pat next year. The drama in the White House seems never-ending with US President Donald Trump replacing his chief of staff Reince Priebus last Friday. Retired General John Kelly was installed in the place. Some analysts noted that could be a turning point for Trump as he’s now shaking up his top team.

Russia orders 755 US diplomats to leave

Meanwhile, Russian President Vladimir Putin said on Sunday that he ordered US to cut diplomatic staff in the country. Putin said that was a response to the "illegal restrictions" imposed by US. That came days after US Congress passed a new round of sanctions for punishing Russia for interfering in last year’s election and military agrees in Ukraine and Syria. It’s initially reported that Russia asked 755 US diplomats to go. And after that, the total number of American diplomats in Russia will be brought down to 455, same as Russian diplomats in US.

Non-farm payroll not likely to help Dollar

There are a number of important economic data from US this week, including ISM indices and non-farm payroll. While the data will be watched closely as usual, we believe it’s unlikely to revive the expectation of faster Fed tightening even if it posts strong upside surprises. The key to Fed’s policy will still lie on the implementation of Trump’s fiscal policies and tax reforms. Without that, markets will continue to doubt whether the US economy can withstand another more rate hikes. On the other hand, we could very likely see another round of selloff in the greenback if NFP disappoints.

ECB Lautenschlaeger: It’s important to prepare for the exit in good time

In Eurozone, ECB governing council member Sabine Lautenschlaeger said in a newspaper remarks that "the expansionary monetary policy has both advantages and side effects. As time passes, the positive effects get weaker and the risks increase." And, she urged that "it’s important to prepare for the exit in good time." But she noted that "what’s crucial in that context is a stable trend in the rate of inflation towards our objective of just under 2 percent. It’s not quite there yet."

Released today…

Official China PMI manufacturing dropped to 51.4 in July, down from 51.7 and missed expectation of 51.5. Official non-manufacturing PMI dropped to 54.5, down from 54.9. Japan industrial production rose 1.6% mom in June, housing starts rose 1.7% yoy. New Zealand building permits dropped -1.0% mom in June. Australia TD securities inflation rose 0.1% mom in July.

In European session, German retail sales rose 1.1% mom in June. UK will release mortgage approvals an M4 money supply. Eurozone CPI will be a key focus and unemployment rate will also be featured. Canada will release IPPI and RMPI later in the day while US will release pending home sales.

RBA and BoE watched closely ahead too

While there are a number of key events ahead, RBA rate decision will be the first one to watch. The RBA meeting due tomorrow would bring no change in the monetary policy. However, the central bank’s "neutral rate" rhetoric gave Aussie a boost. At the July meeting minutes, RBA noted that neutral nominal cash rate is currently at around 3.5%, "given that medium-term inflation expectations were well anchored around 2.5%, although there is significant uncertainty around this estimate". We would like to see if policymakers do any tweak or elaboration on such reference this week. RBA’s Monetary Policy Statement due on Friday would provide update economic forecasts.

BoE Super Thursday will be another key focus. It would be of great interest to see how policymakers vote for the policy, after the 5-3 split (Ian McCafferty, Kristin Forbes and Michael Saunders voting for a rise) in June. The dilemma facing the UK is overshooting inflation on one side and lackluster economic growth together with great uncertainty in Brexit negotiation on the other side. The July inflation report show moderation on the price level the headline reading stayed above the BoE’s 2% target. UK’s 2Q17 GDP grew 0.3% with the first half growth regarded as "notable slowdown" by the government. We believe the Bank rate would stay unchanged at 0.25%. BoE’s quarterly inflation report would also be released alongside the meeting minutes.

Here are some more highlights for the week ahead:

- Tuesday: RBA rate decision; China Caixin PMI manufacturing; Eurozone GDP, PMI manufacturing revisions; UK PMI manufacturing; US personal income and spending, ISM manufacturing

- Wednesday: New Zealand employment; Australia building approvals, Japan consumer confidence; Swiss retail sales, SVME PMI; Eurozone PPI; US ADP employment

- Thursday: Australia trade balance; Eurozone retail sales, PMI services revision, ECB bulletin; UK PMI services, BoE rate decision; US jobless claims, ISM services, factory orders

- Friday: Australia retail sales; Japan labor cash earnings; German factory orders; Canada trade balance, employment, Ivey PMI; US non-farm payrolls, trade balance

USD/JPY Daily Outlook

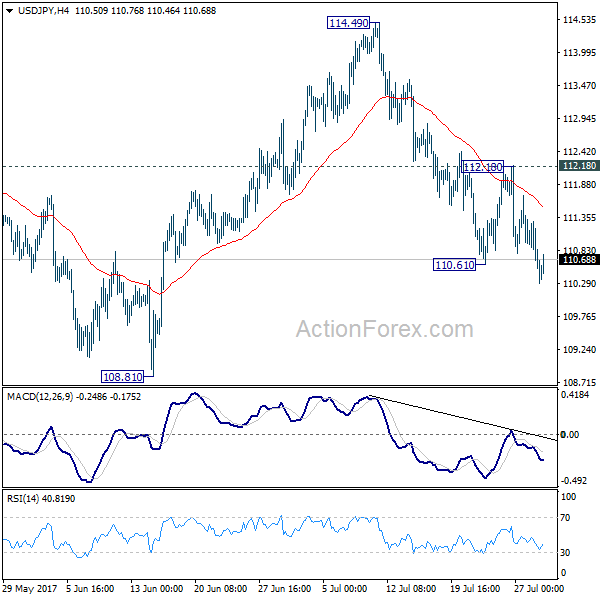

Daily Pivots: (S1) 110.36; (P) 110.84; (R1) 111.14; More…

USD/JPY recovers mildly today but stays well below 112.18 resistance. Intraday bias remains on the downside for the moment. Current decline from 114.49 should extend to 108.81 support first. Break there will resume whole correction from 118.65 and target 61.8% retracement of 98.97 to 118.65 at 106.48. Nonetheless, break of 112.18 resistance will dampen this bearish view and turn focus back to 114.49 resistance instead.

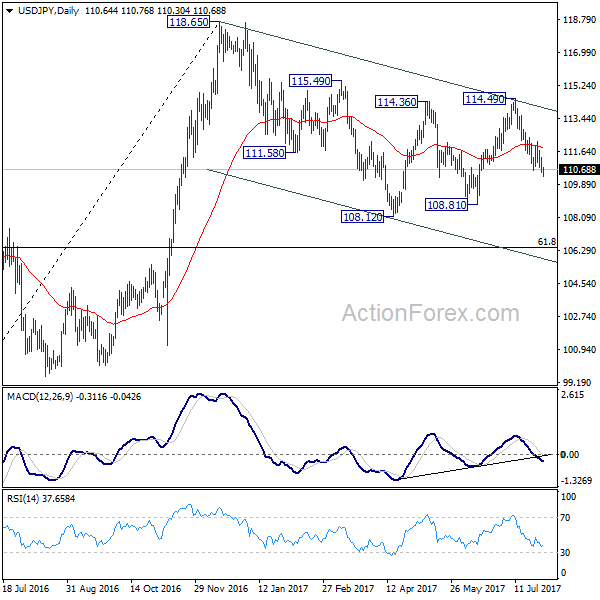

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85. If fall from 118.65 extends lower, down side should be contained by 61.8% retracement of 98.97 to 118.65 at 106.48 and bring rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jun | -1.00% | 7.00% | 6.90% | |

| 23:50 | JPY | Industrial Production M/M Jun P | 1.60% | 1.50% | -3.60% | |

| 1:00 | AUD | TD Securities Inflation M/M Jul | 0.10% | 0.10% | ||

| 1:00 | CNY | Manufacturing PMI Jul | 51.4 | 51.5 | 51.7 | |

| 1:00 | CNY | Non-manufacturing PMI Jul | 54.5 | 54.9 | ||

| 5:00 | JPY | Housing Starts Y/Y Jun | 1.70% | 0.10% | -0.30% | |

| 6:00 | EUR | German Retail Sales M/M Jun | 1.10% | 0.20% | 0.50% | |

| 8:30 | GBP | Mortgage Approvals Jun | 65K | 65K | ||

| 8:30 | GBP | M4 Money Supply M/M Jun | 0.20% | -0.10% | ||

| 9:00 | EUR | Eurozone Unemployment Rate Jun | 9.20% | 9.30% | ||

| 9:00 | EUR | Eurozone CPI Estimate Y/Y Jul | 1.30% | 1.30% | ||

| 9:00 | EUR | Eurozone CPI – Core Y/Y Jul A | 1.10% | 1.10% | ||

| 12:30 | CAD | Industrial Product Price M/M Jun | -0.20% | |||

| 12:30 | CAD | Raw Materials Price Index M/M Jun | -1.80% | |||

| 14:00 | USD | Pending Home Sales M/M Jun | 1.00% | -0.80% |