For the 24 hours to 23:00 GMT, the AUD rose 0.55% against the USD and closed at 0.6942.

LME Copper prices declined 2.4% or $139.5/MT to $5,646.0/MT. Aluminium prices fell 0.9% or $14.0/MT to $1,546.0/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6969, with the AUD trading 0.39% higher against the USD from yesterday’s close.

Overnight data showed that Australia’s house price index rose 1.6% on a quarterly basis in the first quarter of 2020, compared to a rise of 3.9% in the previous month.

The Reserve Bank of Australia (RBA), in its meeting minutes, stated that the current slowdown of economy could be “shallower than earlier expected.” Although, it has also warned that there will be prolonged downturn in consumer demand and investment, and expected contractions in GDP by 6.3%, amid second wave of coronavirus infections in the country. Moreover, the central bank induced multiple stimulus measures to brace the economy from the impact of coronavirus during the year. Also, the central bank noted gradual recovery for Australia economy in nearby time.

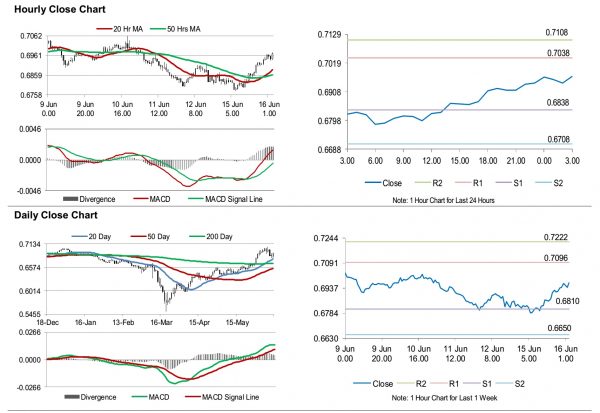

The pair is expected to find support at 0.6838, and a fall through could take it to the next support level of 0.6708. The pair is expected to find its first resistance at 0.7038, and a rise through could take it to the next resistance level of 0.7108.

Looking ahead, traders would keep a watch on Australia’s Westpac leading index for May, slated to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.