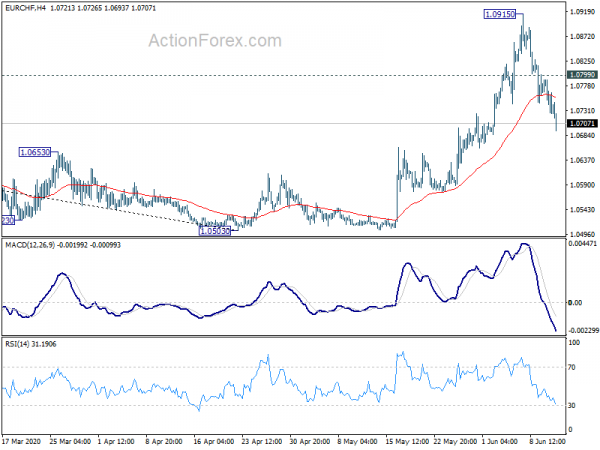

Daily Pivots: (S1) 1.0710; (P) 1.0751; (R1) 1.0775; More…

EUR/CHF’s break of 1.0744 minor support suggests that rebound from 1.0503 has completed earlier than expected at 1.0915. Intraday bias is now back on the downside for 55 day EMA (now at 1.0640). Sustained break there will bring retest of 1.0503 low. On the upside, though, above 1.0799 minor resistance will turn bias to the upside for retesting 1.0915 instead.

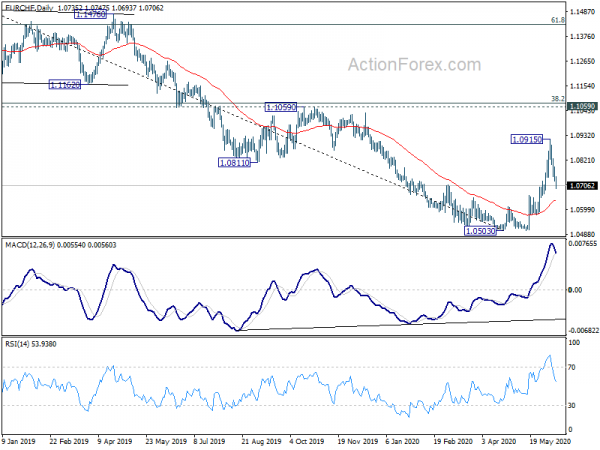

In the bigger picture, the strong break of 1.0811 key support turned resistance suggests that whole down trend from 1.2004 (2018 high) has completed at 1.0503. Rise from 1.0503 could either be correcting the down trend from 1.2004. Or it could be starting a new up trend. Focus is now on 1.1059 cluster resistance (38.2% retracement of 1.2004 to 1.0503 at 1.1076). Decisive break there will pave the way to 61.8% retracement at 1.1431 and above. Though, rejection by 1.1059/76 will revive medium term bearishness.