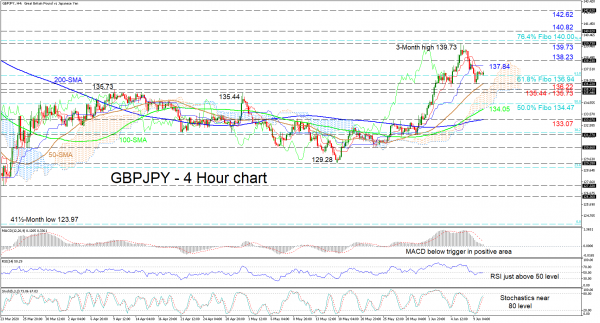

GBPJPY is currently fixed at the 136.94 level, that being the 61.8% Fibonacci retracement of the down leg from 144.94 to the 41½-month low of 123.97. The pair’s retreat from the fresh three-month high of 139.73 may edge towards the 50-period simple moving average (SMA) and the Ichimoku cloud. This is also reflected by the negative momentum from the red Tenkan-sen line and the stalled state of the blue Kijun-sen line.

The MACD has weakened below its red trigger line close to the zero mark, while the RSI hovers just above the 50 threshold. Moreover, the stochastic lines are rising towards the 80 overbought level. Noteworthy are all SMAs, which continue to sustain a positive bearing, suggesting further advances.

If buyers re-emerge, early hindrance could come from the blue Kijun-sen line at 137.84 ahead of the 138.23 high. A jump above could see price revisit the three-month peak of 139.73 prior to challenging the 76.4% Fibo of 140.00 overhead. Gaining more ground, the pair may next encounter the inside swing lows of 140.82 and 142.62 from January 6 and February 24 respectively.

Alternatively, a decline underneath the 61.8% Fibo of 136.94 could see initial support surface at the 136.22 trough, where the 50-period SMA is located. If sellers make further efforts to push down, they may then face the Ichimoku cloud and the area of inside swing highs from 135.44 – 135.73, before extending towards the 50.0% Fibo of 134.47. Another leg lower, the price could see the 100-period SMA at 134.05 before the 133.07 obstacle, where the 200-period SMA also lies.

In brief, the very short-term timeframe sustains a bullish tone above the Ichimoku cloud and the 135.44 – 135.73 support section, with a break above 140.00 attracting traders’ attention.