GBP/USD – 1.3090

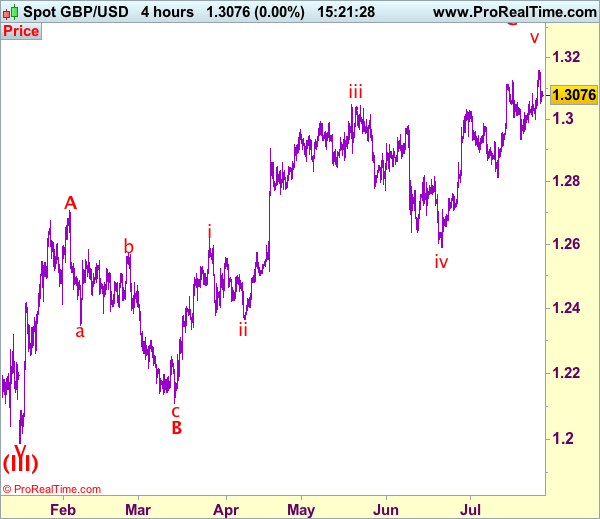

Recent wave: Wave V of larger degree wave (III) has ended at 1.1986 and major correction has commenced from there for gain to 1.3000 and 1.3140-50

Trend: Near term up

New strategy :

Stand aside

Position: –

Target: –

Stop:-

Despite rising to 1.3159 yesterday, lack of follow through buying and the subsequent retreat suggest consolidation below this level would be seen and pullback to 1.3050 cannot be ruled out, however, break of 1.2995-00 is needed to suggest a temporary top is possibly formed, bring retracement of recent rise to 1.2955-60 but support at 1.2933 should hold from here.

On the upside, expect recovery to be limited to 1.3120-25 and said resistance at 1.3159 should hold, bring further consolidation, only break of said resistance at 1.3159 would signal recent upmove has once again resumed and extend further gain to 1.3190-00, however, as this move is still viewed as the final wave v of larger degree wave C, reckon upside would be limited to 1.3240-50 and price should falter below 1.3300-10, then sterling shall retreat sharply from there.

Our preferred count on the daily chart is that cable’s rebound from 1.3500 (wave (A) trough) is unfolding as a wave (B) with A ended at 1.7043, followed by triangle wave B and wave C as well as wave (B) has ended at 1.7192, the subsequent selloff is the larger degree wave (C) which is still unfolding with minor wave (III) of larger degree wave 3 ended at 1.1986, hence wave (IV) correction is in progress which could either be a triangle wave (IV) of a complex formation but upside should be limited to 1.3500 and price should falter well below 1.4000, bring another decline in wave (V) of 3 for weakness to 1.1500, then 1.1200.