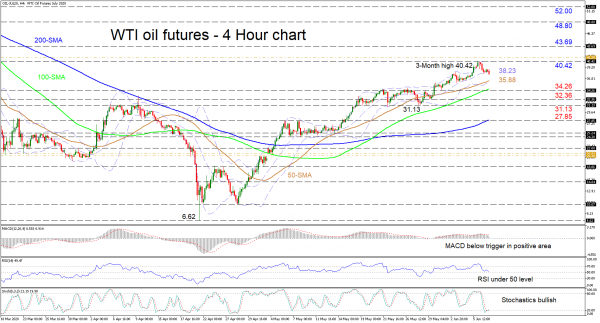

WTI oil futures presently appear to be retracing under the mid Bollinger band around 38.23, heading towards the 50-period simple moving average (SMA) at 35.88. The commodity’s one-and-a-half month hike from the 6.62 bottom, pivoted back down just before filling the gap from early March at 41.28. Nevertheless, the SMAs continue to back the positive picture within the commodity.

The short-term oscillators at the moment reflect conflicting signals in directional momentum. The MACD, in the positive region, has marginally dipped under its red signal line, while the RSI has pierced below its neutral threshold. However, the stochastic oscillator reflects growing positive momentum with the %K line completing a bullish crossover of the %D line and exiting the oversold territory.

To the upside, resistance could originate from the three-month high of 40.42 – where the upper Bollinger band lies – and the upper surface of the gap at 41.28. Overrunning this border, the key inside swing low of 43.69 from March 2 could challenge the revival of the climb. If more gains evolve, the price could shoot for the 48.80 obstacle ahead of the 52.00 high from February 25.

Should sellers steer below the mid-Bollinger band, initial support could arise from the 50-period SMA joined by the lower Bollinger band at 35.88. A dip underneath may meet the 100-period SMA residing at the 34.26 low. Next, the 32.36 and 31.13 lows could prevent efforts to decline towards the 200-day SMA, which is located at the 27.85 significant barrier.

Summarizing, the very short-term bias maintains its bullish mode above 31.13 and a break above 43.69 could boost the positive outlook.