Key Highlights

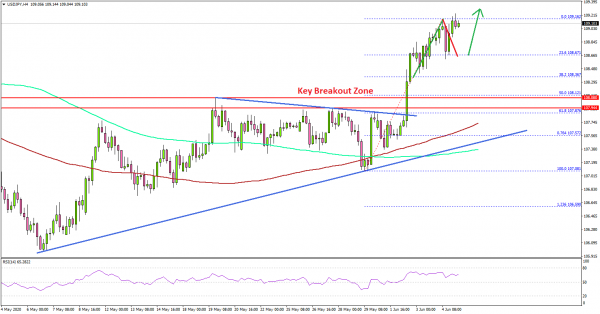

- USD/JPY started a strong increase and broke a major hurdle at 108.00.

- There was a break above a key bearish trend line at 107.85 on the 4-hours chart.

- The US Initial Jobless Claims in the week ending May 30, 2020 declined from 2126K to 1877K.

- The US nonfarm payrolls are likely to decrease 8,000K in May 2020, less than the last -20500K.

USD/JPY Technical Analysis

After a long struggle, the US Dollar started a strong increase from 107.00 against the Japanese Yen. USD/JPY broke many important hurdles near 108.00 to move into a positive zone.

Looking at the 4-hours chart, the pair settled nicely above the 108.00 level, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It broke the 109.00 level and traded to a new multi-week high at 109.16. Recently, there was a downside correction from 109.16 and the pair tested the 23.6% Fib retracement level of the upward move from the 107.08 low to 109.16 high.

On the downside, there is a major support base forming near the 108.20 and 108.00 levels (the recent breakout zone). The 50% Fib retracement level of the upward move from the 107.08 low to 109.16 high is also near 108.10.

If the pair extends its downside correction, the pair is likely to find bids near the 108.20 and 108.10 levels. On the upside, the pair might struggle to clear the 109.20 level, above which it could easily test the 110.00 level.

Fundamentally, the US Initial Jobless Claims figure for the week ending May 30, 2020 was released by the US Department of Labor. The market was looking for a decline from 2123K to 1800K.

The actual result was lower than the forecast as the US Initial Jobless Claims came in at 1877K. The last reading was revised from 2123K to 2126K.

The report added:

The 4-week moving average was 2,284,000, a decrease of 324,750 from the previous week’s revised average. The previous week’s average was revised up by 750 from 2,608,000 to 2,608,750.

Overall, USD/JPY is likely to continue higher and dips might find support near 108.00. Looking at EUR/USD, the pair surged above the 1.1220 level, and GBP/USD settled above 1.2500.

Upcoming Economic Releases

- US nonfarm payrolls May 2020 – Forecast -8000K, versus -20500K previous.

- US Unemployment Rate May 2020 – Forecast 19.8%, versus 14.7% previous.

- Canada’s employment Change payrolls May 2020 – Forecast -500K, versus -1993.8K previous.

- Canada’s Unemployment Rate May 2020 – Forecast 15%, versus 13% previous.