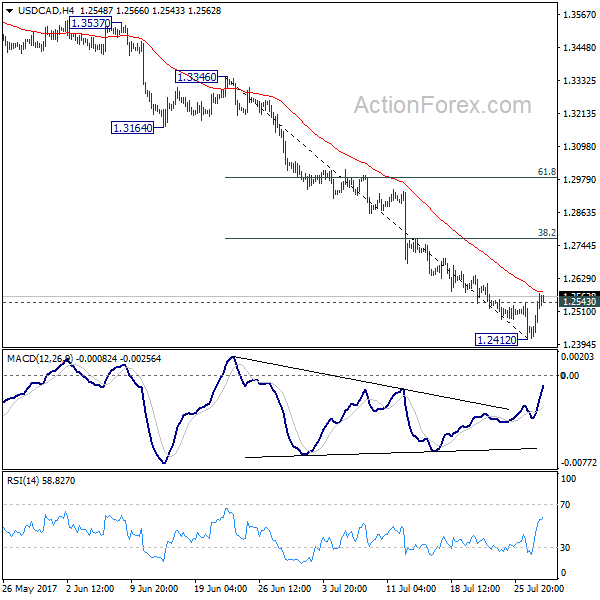

Daily Pivots: (S1) 1.2452; (P) 1.2513; (R1) 1.2614; More….

Break of 1.2543 minor resistance is seen as an indication of short term bottoming, on bullish convergence condition in 4 hour MACD, after drawing support from 1.2460 key level. Intraday bias is turned to the upside for 38.2% retracement of 1.3346 to 1.2412 at 1.2769 first. On the downside, through, sustained trading below 1.2460 will extend the whole decline from 1.3793 to next key fibonacci level at 1.2048.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Fall from 1.3793 is seen as the third leg and should target 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. However, firm break there will target 100% projection of 1.4689 to 1.2460 from 1.3793 at 1.1564.