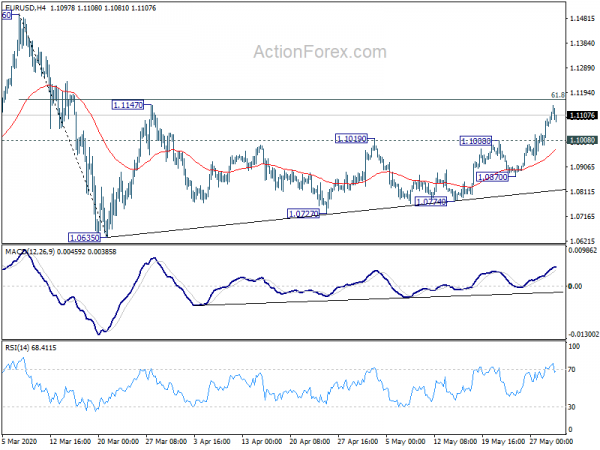

EUR/USD surges to as high as 1.1145 last week as consolidation pattern form 1.0635 extended with another rise. Initial bias stays on the upside this week. But we’d expect upside to be limited by 61.8% retracement of 1.1496 to 1.0635 at 1.1167. On the downside, below 1.1008 resistance turned support will turn intraday bias to the downside for 1.0870 support. However, sustained break of 1.1167 will pave the way to 1.1496 key resistance next.

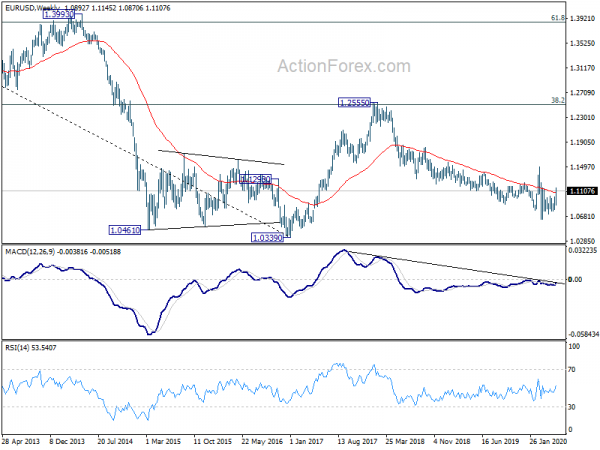

In the bigger picture, as long as 1.1496 resistance holds, whole down trend from 1.2555 (2018 high) should still be in progress. Next target is 1.0339 (2017 low). However, sustained break of 1.1496 will argue that such down trend has completed. Rise from 1.0635 could then be seen as the third leg of the pattern from 1.0339. In this case, outlook will be turned bullish for retesting 1.2555.

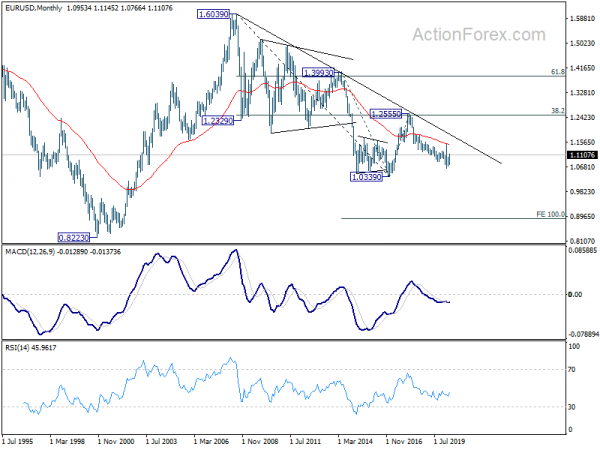

In the long term picture, outlook remains bearish for now. EUR/USD is held below decade long trend line that started from 1.6039 (2008 high). It was also rejected by 38.2% retracement of 1.6039 to 1.0339 at 1.2516 before. On break of 1.0339, next target will be 100% projection of 1.3993 to 1.0339 from 1.2555 at 0.8901.