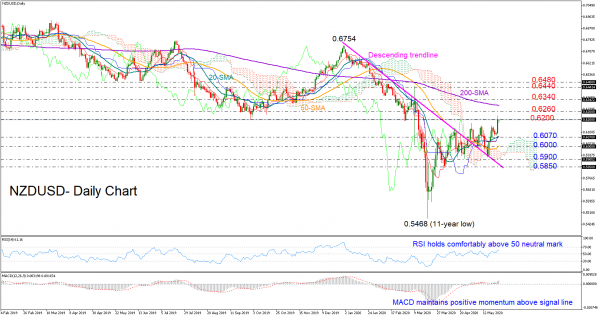

NZDUSD is recording its second week of gains thanks to the descending trendline stretched from the 0.6754 peak that managed to curb downside corrections once again, allowing the price to advance to a 2 ½-month high of 0.6227 on Tuesday.

The RSI and the MACD are still in favour of bullish actions but the pair has several key obstacles to go through on the way up. First is the 0.6200-0.6260 restrictive zone which is currently under examination. Clearing this area, the 200-day simple moving average (SMA) and the 0.6340 former resistance level could immediately come to the rescue, blocking any improvement towards the 0.6440-0.6480 region.

Otherwise, failure to close above 0.6200 may put the market under pressure, pushing support towards the 20-day SMA around 0.6070. Beneath that, the 0.6000 round-level, where the 50-day SMA is currently hovering, may attract some attention before the spotlight turns to the 0.5900-0.5850 region and again to the descending trendline.

Looking at the medium-term picture, the outlook remains bearish as long as the pair trades below 0.6340.

In brief, NZDUSD continues to face upside risks, though any positive move should be treated carefully as the pair is approaching key resistance levels.