Dollar bulls are clearly unhappy with the FOMC statement today. Fed kept target range for the federal funds rate at 1 to 1.25% as widely expected. The new FOMC statement was almost a carbon copy of the May’s one. The exceptions are firstly, Fed indicated that it will start the "balance sheet normalization program relatively soon". Secondly, Fed took the part that "job gains have moderated" and just described that "job gains have been solid". It’s clear that markets are taking the message that Fed is going to announce the plan to shrink the balance sheet in September. And Fed will hold it cards for another rate hike till December to see how the economy evolves.

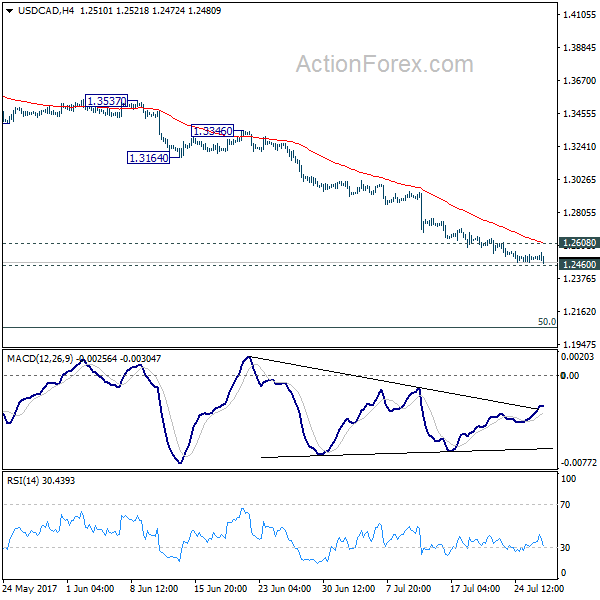

At the time of writing, USD/CAD has already breached this week’s low to extend recent down trend. Strength in oil price after inventory data is certainly a factor Key focus will remain on 1.2460 major support. We stay cautious on strong support from this level to bring rebound, considering loss of downside momentum as seen in bullish convergence condition in 4 hour MACD. But sustained break of 1.2460 will pave the way to next medium term fibonacci level at 1.2048.

Despite the strong rebound since making a low at 110.61 on Monday, USD/JPY was held well below 112.41 resistance. Near term outlook remains bearish. Break of 110.61 will affirm our bearish view that recent fall from 118.65 is still in progress for another low below 108.12, possibly to next medium term fibonacci level at 106.48.

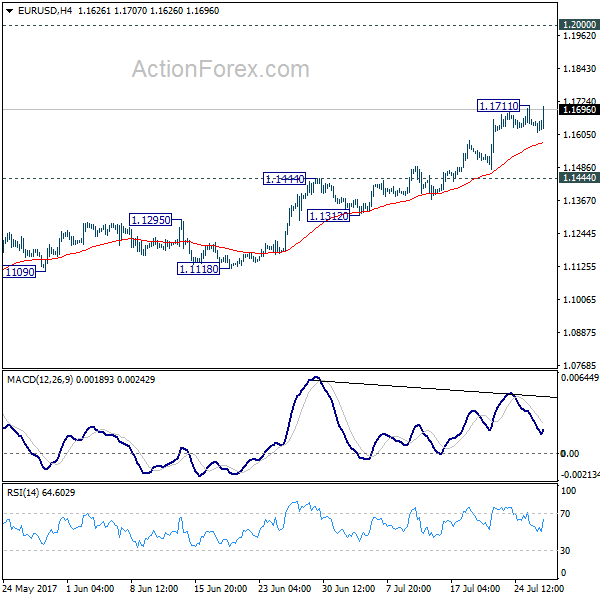

At the time of writing, EUR/USD is still limited below 1.1711 temporary top. But overall outlook stays bearish with the pair kept well above 1.1444 resistance turned support. We’d expect a break of 1.1711 to extend recent rally to 1.2 handle.