Key Highlights

- EUR/USD failed to continue above 1.0900 and declined towards 1.0780.

- A major support base is forming near 1.0780 and 1.0750 on the 4-hours chart.

- The Euro Area GDP decreased by 3.8% in Q1 2020 (QoQ) (Prelim).

- The number of employed persons declined by 0.2% in Q1 2020 (QoQ) (Prelim).

EUR/USD Technical Analysis

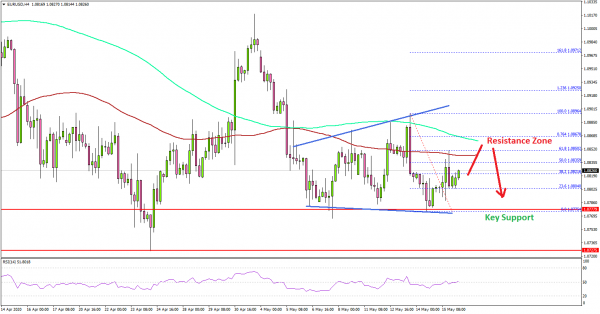

This past week, the Euro made another attempt to recover above 1.0900 against the US Dollar, but it failed. EUR/USD traded as high as 1.0896 before it started a fresh decline.

Looking at the 4-hours chart, the pair is facing many important resistances near the 1.0900 level. It traded below the 1.0850 support and settled below the 200 simple moving average (green, 4-hours).

The decline was such that the pair even broke the 100 simple moving average (red, 4-hours) and tested the 1.0780 support zone. Later, there was an upside correction above 1.0800.

However, the upward move was capped by the 50% Fib retracement level of the downward move from the 1.0896 high to 1.0775 low. On the upside, there is clearly a few key barriers near 1.0880 and 1.0900.

A successful close above the 1.0900 resistance is must to start a steady rise towards the 1.0950 and 1.0980 levels. On the downside, the first major support is near the 1.0780, followed by 1.0750.

If there is a daily close below the 1.0750 support zone, EUR/USD could extend its decline aggressively. The next major support is near 1.0680, followed by 1.0650.

Fundamentally, the Euro Area Gross Domestic Product report for Q1 2020 (prelim) was released this past Friday by the Eurostat. The market was looking for a 3.8% decline in the GDP compared with the previous quarter.

The actual result was similar to the forecast, as the Euro Area GDP decreased by 3.8% in Q1 2020 (QoQ). Looking at the yearly change, there was a 3.2% decline the GDP, less than the 3.3% forecast.

The report added:

These were the sharpest declines observed since time series started in 1995. In March 2020, the final month of the period covered, COVID-19 containment measures began to be widely introduced by Member States.

Overall, EUR/USD must stay above 1.0780 and 1.0750 to start a substantial recovery in the near term. Looking at GBP/USD, the pair declined heavily below the 1.2200 support area.

Upcoming Economic Releases

- NAHB Housing Market Index for May 2020 – Forecast 35.0, versus 30.0 previous.