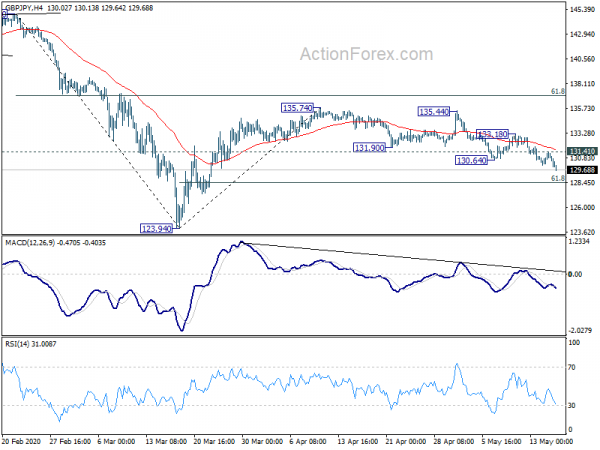

GBP/JPY’s decline resumed last week to close at 129.68. The development affirmed the view that corrective rebound form 123.94 has completed at 135.74. Initial bias stays on the downside this week for 61.8% retracement of 123.94 to 135.74 at 128.44. Firm break there will target a test on 123.94 low. On the upside, above 131.41 minor resistance will turn intraday bias neutral first.

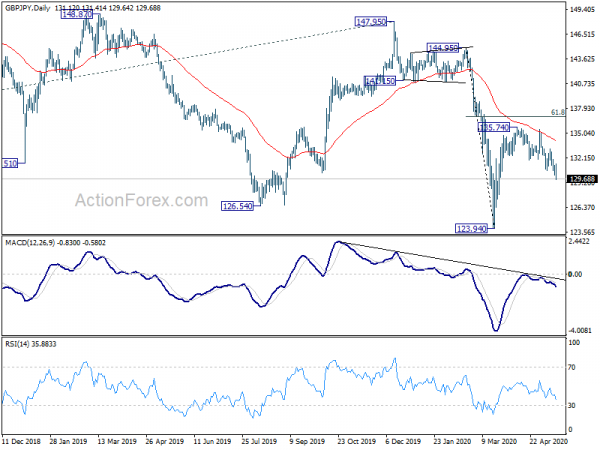

In the bigger picture, price actions from 122.75 (2016 low) are merely a sideway consolidation pattern, which has completed at 147.96. Larger down trend from 195.86 (2015 high) as well as that from 251.09 (2007 high) are possibly resuming. Break of 122.75 should target 61.8% projection of 195.86 to 122.75 from 147.95 at 102.76 next. In any case, outlook will remain bearish as long as 147.95 resistance holds.

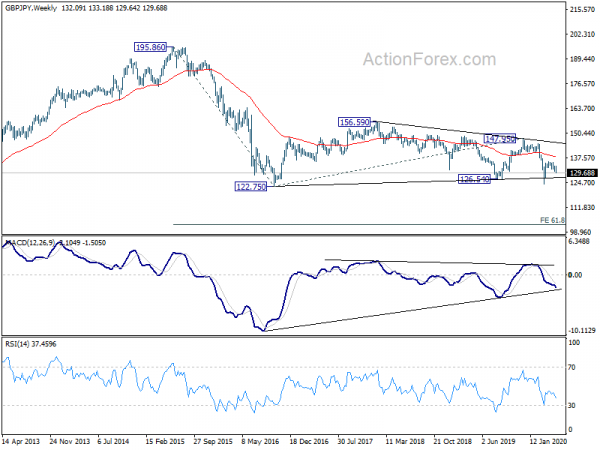

In the longer term picture, repeated rejection by 55 month EMA indicate long term bearishness in the cross. Down trend from 251.09 (2007 high) could be resuming. Break of 116.83 will target 61.8% projection of 195.86 to 122.75 from 147.95 at 102.76 next.