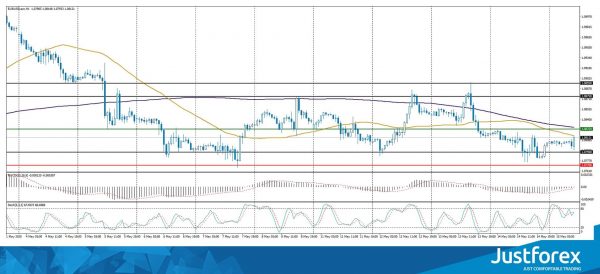

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.08150

Open: 1.08034

% chg. over the last day: -0.12

Day’s range: 1.07933 – 1.08148

52 wk range: 1.0777 – 1.1494

There is an ambiguous technical pattern on the EUR/USD currency pair. A trading instrument is consolidating. Financial market participants expect additional drivers. At the moment, the local support and resistance levels are 1.0790 and 1.0825, respectively. We expect the publication of important statistics. Positions should be opened from key levels.

The Economic News Feed for 15.05.2020

German GDP data at 11:00 (GMT+3:00);

Report on retail sales in the US at 15:30 (GMT+3:00);

JOLTS job openings at 17:00 (GMT+3:00).

Indicators do not give accurate signals: the price is testing 50 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 1.0790, 1.0770, 1.0740

Resistance levels: 1.0825, 1.0875, 1.0895

If the price fixes below 1.0770, a further fall in the EUR/USD currency pair is expected. The movement is tending to 1.0740-1.0720.

An alternative could be the growth of EUR/USD quotes to 1.0860-1.0880.

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.22220

Open: 1.22215

% chg. over the last day: -0.02

Day’s range: 1.21874 – 1.22385

52 wk range: 1.1466 – 1.3516

The GBP/USD currency pair has become stable. The British pound is currently consolidating. There is no defined trend. The key support and resistance levels are 1.2180 and 1.2250, respectively. The British pound is still under pressure since the Bank of England does not exclude the possibility of reducing the base rate to a negative level. GBP/USD quotes have the potential for further decline. We recommend opening positions from key levels.

The news feed on the UK economy is calm.

Indicators do not give accurate signals: the price is testing 50 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates the bullish sentiment.

Trading recommendations

Support levels: 1.2180, 1.2140, 1.2100

Resistance levels: 1.2250, 1.2285, 1.2335

If the price fixes below 1.2180, a further drop in GBP/USD quotes is expected. The movement is tending to 1.2140-1.2120.

An alternative could be the growth of the GBP/USD currency pair to 1.2290-1.2330.

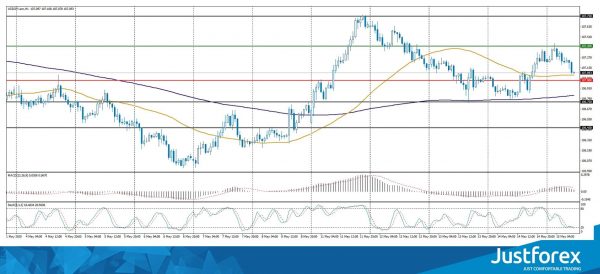

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.40986

Open: 1.40430

% chg. over the last day: -0.36

Day’s range: 1.40183 – 1.40595

52 wk range: 1.2949 – 1.4668

USD/CAD quotes have been declining. The trading instrument has updated local lows. The loonie is currently consolidating. The key range is 1.4015-1.4065. The USD/CAD currency pair has the potential for further decline. The Canadian dollar is supported by the recovery of “black gold” prices. Positions should be opened from key levels.

The publication of important economic releases from Canada is not planned.

Indicators do not give accurate signals: the price has crossed 100 MA.

The MACD histogram is in the negative zone and continues to decline, which gives a strong signal to sell USD/CAD.

Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which indicates the bearish sentiment.

Trading recommendations

Support levels: 1.4015, 1.3970

Resistance levels: 1.4065, 1.4115, 1.4140

If the price fixes below the support level of 1.4015, a further drop in USD/CAD quotes is expected. The movement is tending to 1.3980-1.3960.

An alternative could be the growth of the USD/CAD currency pair to 1.4100-1.4120.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 107.040

Open: 107.250

% chg. over the last day: +0.21

Day’s range: 107.078 – 107.434

52 wk range: 101.19 – 112.41

There is an ambiguous technical pattern on the USD/JPY currency pair. The trading instrument is in a sideways trend. At the moment, the key support and resistance levels are 107.00 and 107.40, respectively. USD/JPY quotes are tending to decline. We expect important economic reports from the US. Positions should be opened from key levels.

The news feed on Japan’s economy is calm.

Indicators do not give accurate signals: the price has crossed 50 MA.

The MACD histogram is near the 0 mark.

Stochastic Oscillator is in the neutral zone, the %K line has crossed the %D line. There are no signals at the moment.

Trading recommendations

Support levels: 107.00, 106.75, 106.45

Resistance levels: 107.40, 107.75

If the price fixes below the support level of 107.00, USD/JPY quotes are expected to fall. The movement is tending to 106.75-106.50.

An alternative could be the growth of the USD/JPY currency pair to 107.60-107.90.