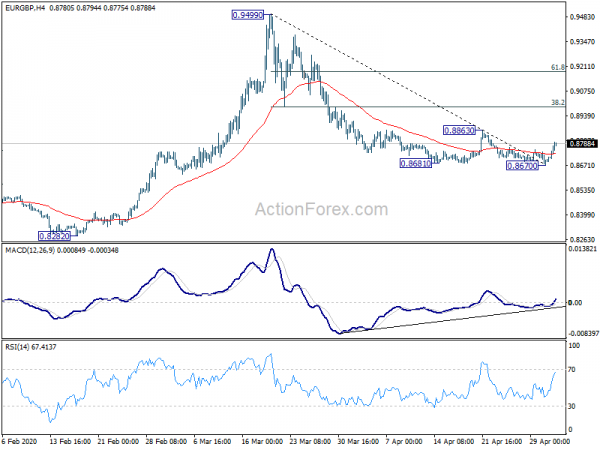

EUIR/GBP edged lower to 0.8670 last week but quickly recovered. Initial bias remains neutral first. Considering bullish convergence condition in 4 hour MACD, a short term bottom might be formed after failing to sustain below 55 day and 55 week EMAs. Focus is back on 0.8863 resistance this week. Break will confirm and turn bias to the upside for 38.2% retracement of 0.9499 to 0.8670 at 0.8987. On the downside, however, break of 0.8670 will resume the fall from 0.9499 to 0.8276/82 key support zone.

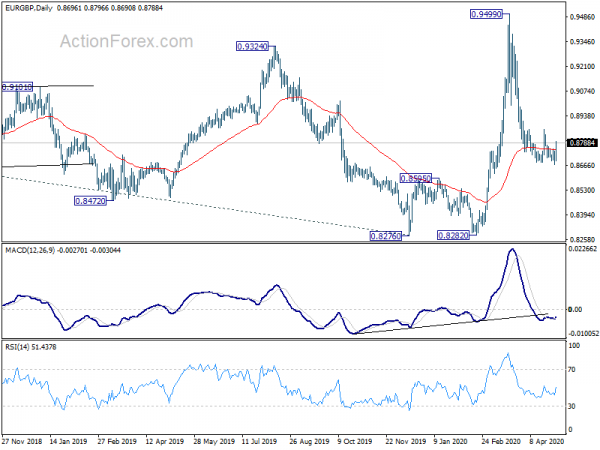

In the bigger picture, while the pull back from 0.9499 is deep, there is no sign of trend reversal yet. The up trend from 0.6935 (2015 low) should resume at a later stage to 61.8% projection of 0.6935 to 0.9263 from 0.8276 at 0.9715. This will remain the favored case as long as 0.8276 support holds.

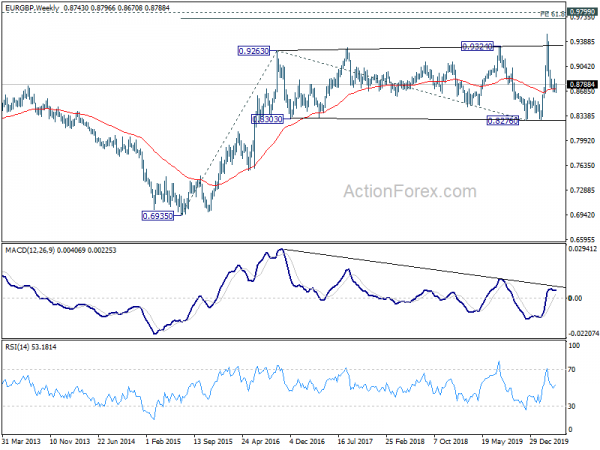

In the long term picture, rise from 0.6935 (2015 low) is still in progress. It could be resuming long term up trend from 0.5680 (2000 low). Decisive break of 0.9799 will target 100% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.