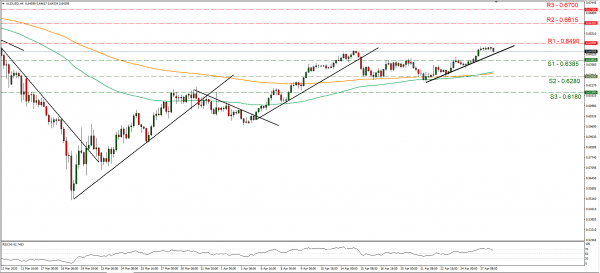

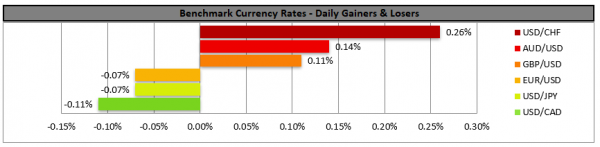

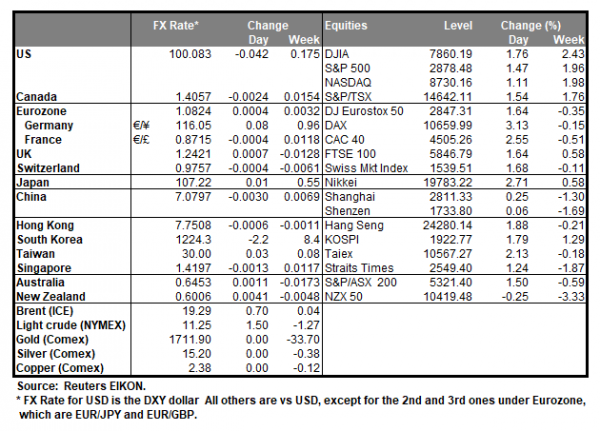

The Australian currency strengthened against the USD yesterday, reaching the highest point since mid-March before correcting lower in today’s Asian session. The market’s confidence may have gotten another lift as lockdown measures tend to ease in various parts of the world in an effort to restart economies, world-wide. Analysts noted that reopening plans have fed a positive market sentiment to start the week, while at the same time may exercise some pressure on the greenback, also due to its safe-haven qualities. It should be noted that Australia seems to have been spared from the high number of deaths marked in other countries and in various parts of the country restrictions are easing. It was characteristic that in Australia home visits are to be allowed, while beaches are to be reopened. We expect that should the risk appetite continue to improve, the AUD may rise further, while Aussie trader’s attention is expected to be turned towards the CPI rates for Q1 which are to be released during tomorrow’s Asian session. AUD/USD rose slightly yesterday nearing the 0.6490 (R1) resistance line, yet during the Asian session relented some ground. We maintain a bullish outlook for the pair as long as it remains above the upward trendline incepted since the 21st of the month. Should the bulls maintain control over the pair’s direction we could see it breaking the 0.6490 (R1) line and aim for the 0.6615 (R2) hurdle. If the bears take over, we could see the pair breaking the 0.6385 (S1) support line and aim for the 0.6280 (S2) support barrier, which contained the pair’s drop on the 16th and 21st of the month.

Pound strengthens slightly as Johnson returns to work

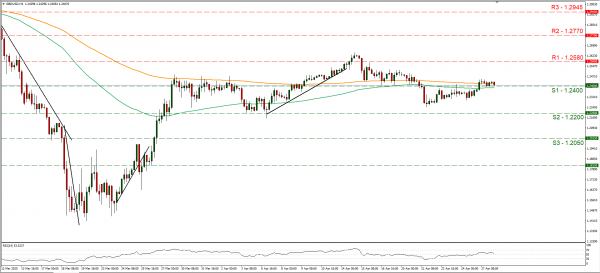

The pound tended to strengthen slightly against both the USD and the common currency yesterday as UK’s Prime Minister Boris Johnson returned to work. UK’s Prime Minister is under pressure to prepare a road map on how the UK is going to lift the lockdown measures imposed, without triggering a second wave of infections of COVID 19. Upon his return to work, UK’s PM thanked Britons for abiding the lockdown measures imposed, yet at the same time said that it was still too dangerous to relax a stringent lockdown which is hurting the economy. UK Media report though, that despite the lockdown measures are not to be reviewed until the 7th of May, an easing may occur even sooner. Trade talks with the EU are still ongoing, via teleconference, yet little progress seems to be made, and the UK government seems to maintain the current deadline to end the negotiations at the end of the year. Analysts tended to note that futures data showed the market turned bearish on the British currency for the first time since December last year. We expect the pound to be influenced by the risk mood and the general market sentiment, however Brexit tends to be a differentiating factor for the GBP. GBP/USD rose yesterday, breaking the 1.2400 (S1) resistance line, now turned to support, yet maintained a sideways movement afterwards, hovering just above it. We tend to maintain our bias towards a sideways movement given the low volatility of the pair, yet the situation may change providing a new direction. Should the pair come under the selling interest of the market we could see it breaking the 1.2400 (S1) support line and aim for the 1.2200 (S2) support level. Should cable’s long positions be favoured by the market, we could see the pair aiming if not breaking the 1.2580 (R1) resistance line.

Other economic highlights today and early tomorrow

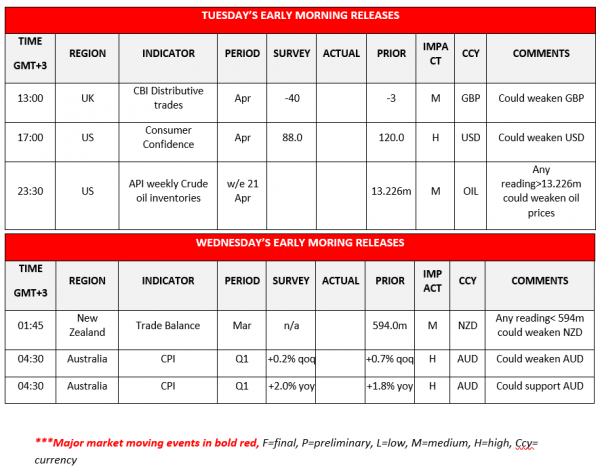

Today during the European session, we get UK’s CBI distributive trades for April. During the American session, we get form the US the consumer confidence indicator for April and just before the Asian session starts, we get from the US, the API weekly crude oil inventories figure. Tomorrow, during the Asian session, we get New Zealand’s trade data for March, as well as Australia’s CPI rates for Q1.

Support: 0.6385 (S1), 0.6280 (S2), 0.6180 (S3)

Resistance: 0.6490 (R1), 0.6615 (R2), 0.6700 (R3)

Support: 1.2400 (S1), 1.2200 (S2), 1.2050 (S3)

Resistance: 1.2580 (R1), 1.2770 (R2), 1.2945 (R3)