- Uncertainty about growth outlook resurfaces after IMF warning, weighing on stocks

- Dollar pulls higher as risk aversion sets in

- US earnings and retail sales data could make for a rocky ride

Stocks muted as growth jitters return

Equity markets were struggling for momentum on Wednesday as the IMF’s latest economic forecasts served as a reminder to investors that the virus crisis will take a heavy toll on the global economy. In its April report, the IMF projected that the global economy would contract by 3% this year, making it the worst downturn since the Great Depression of the 1930s.

The gloomy predictions come amid doubts about the lockdown exit strategy being devised by hard-hit countries as there are worries of a second wave of infections if some measures are relaxed too early and that a complete lifting of restrictions may be a long time away. In the United States, the debate on who has the authority to roll back the social distancing rules has led to a war of words between the President and state governors, with Trump’s eagerness to reopen the economy causing some unease amongst investors.

Hopes that the lockdowns could be eased soon had contributed to yesterday’s risk-on tone, helping traders to shrug off disappointing earnings results on Wall Street as the season gets underway. JP Morgan, which reported a big miss in its Q1 earnings per share on Tuesday, said it had set aside almost $7 billion for bad loan provisions, underlining the scale of the potential loan defaults by consumers and businesses from the virus fallout.

Bank of America, Citigroup and Goldman Sachs will be the next major banks to report their earnings today.

Despite the negative sentiment, however, trading was relatively subdued, with US stock futures down about 1%, as the series of interventions undertaken by the Federal Reserve over the past month appear to have sedated the markets.

Dollar bounces back, knocks down rivals

The Fed’s extraordinary actions to backstop just about every part of the US economy may have been a boon for equities but they probably put a ceiling on the dollar’s rally. Still, while it’s hard to see the greenback reaching new heights with the liquidity squeeze having subsided, neither is it likely to go out of favour anytime soon.

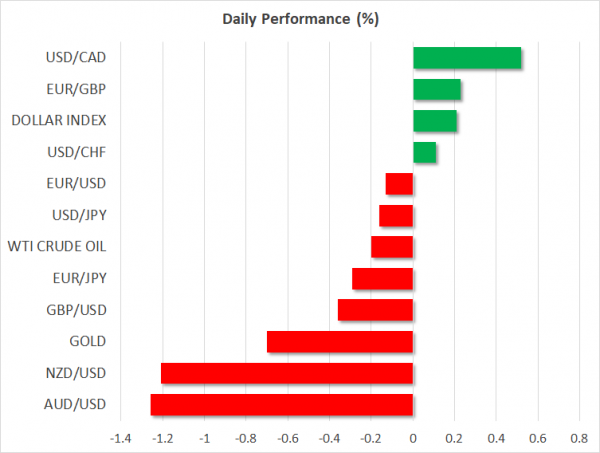

The dollar index quickly recovered from a 2-week low brushed overnight to climb almost 0.5% as the risk-on mood soured.

The euro was down about 0.4% despite the Vice President of the European Commission reviving hopes of coronabonds to raise possibly up to 1.5 trillion euros in virus recovery funds. The pound also slipped, giving up all of yesterday’s gains, but the Australian and New Zealand dollars were the worst performers, plunging by more than 1%, with a big drop in Australian consumer sentiment weighing on the two currencies.

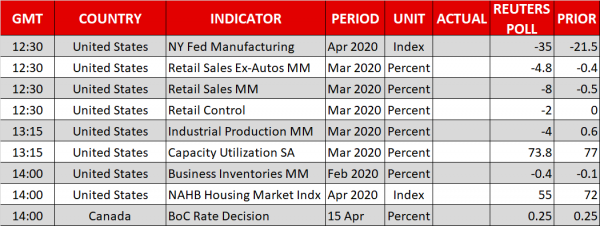

US retail sales, Bank of Canada coming up; earnings to continue

The Canadian dollar was another big loser as oil prices extended their decline. Moreover, there is speculation that the Bank of Canada might ease policy further when it meets later today by beefing up its quantitative easing programme, and that could further undermine the loonie.

Attention will also be on US retail sales and industrial production numbers out of the United States later today. Retail sales are expected to have plummeted by a staggering 8% over the month in March. Given the shaky market sentiment today, a worse figure could aggravate the risk-off moves.