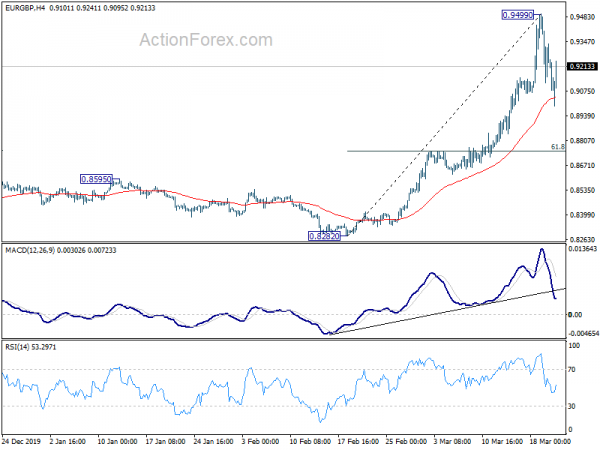

EUR/GBP surged to as high as 0.9499 last week, then formed a short term top there and retreated. Initial bias is neutral this week for some more consolidations first. In case of deeper pull back, downside should be contained by 61.8% retracement of 0.8282 to 0.9499 at 0.8747 to bring rally resumption. On the upside, break of 0.9499 will resume larger up trend.

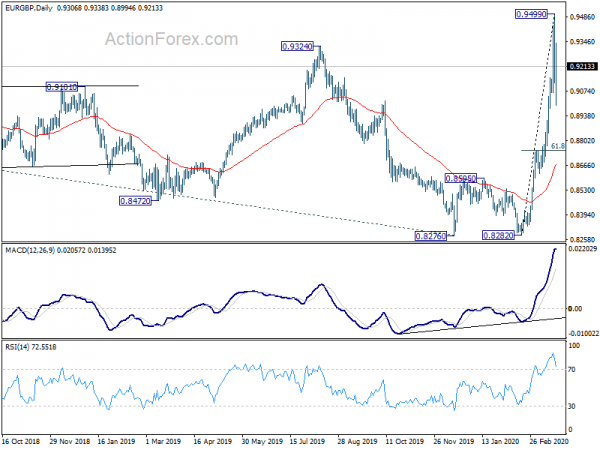

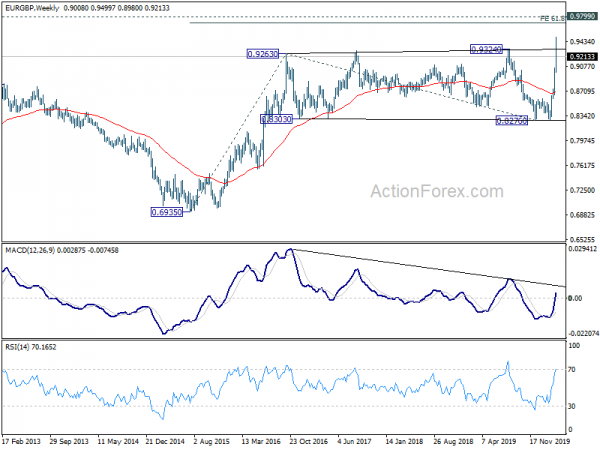

In the bigger picture, the break of 0.9324 (2016 high) confirms resumption of up trend from 0.6935 (2015 low). Next target is 61.8% projection of 0.6935 to 0.9263 from 0.8276 at 0.9715. Initial resistance could be seen around there as it’s close to 0.9799 (2008 high). But in any case, medium term outlook will stay bullish as long as 0.8276 support holds, even in case of deep pull back.

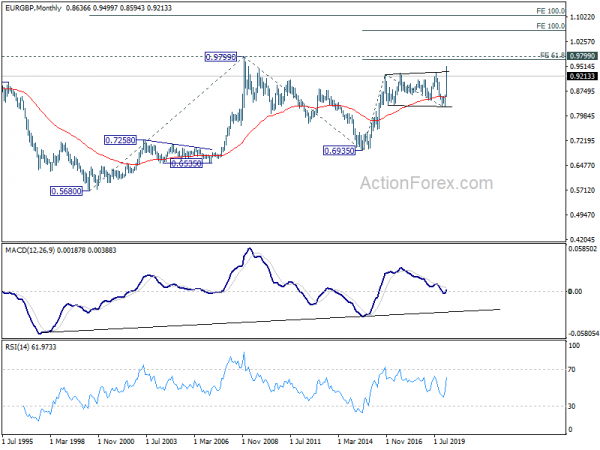

In the long term picture, rise form 0.6935 (2015 low) is still in progress. It could be resuming long term up trend from 0.5680 (2000 low). Decisive break of 0.9799 will target 100% projection of 0.5680 to 0.9799 from 0.6935 at 1.1054.