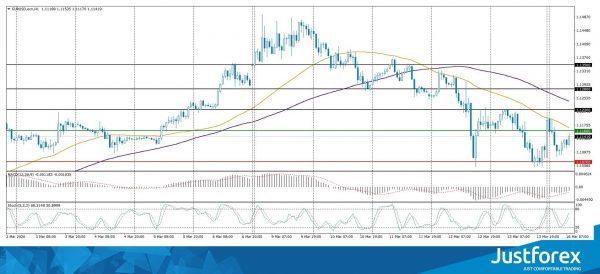

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.11739

Open: 1.10831

% chg. over the last day: -0.36

Day’s range: 1.10849 – 1.11981

52 wk range: 1.0879 – 1.1572

The technical picture on the EUR/USD currency pair is ambiguous. The trading instrument is in sideways movement. Unidirectional trend is not observed. The U.S. Federal Reserve has sharply reduced the key interest rate range to 0-0.25%. Such measures were taken in order to combat the risks due to the coronavirus COVID-19 spread. A number of countries around the world have announced a stricter regime as a means of combating the epidemic. At the moment EUR/USD quotes are consolidating in the range of 1.10700-1.11600. Open positions from these markers.

Today the news background is quite calm. No important economic releases are planned for publication.

Indicators do not give accurate signals: the price is consolidating near 50 MA.

The MACD histogram is in the negative zone, but above the signal line, which gives a weak signal to sell EUR/USD.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates a bullish mood.

Trading recommendations

Support levels: 1.10700, 1.10000

Resistance levels: 1.11600, 1.12200, 1.12800

If the price fixes above 1.11600, EUR/USD quotes are expected to rise. Movement is tending to 1.12200-1.12800.

Alternatively, the EUR/USD currency pair may decline to the round level of 1.10000.

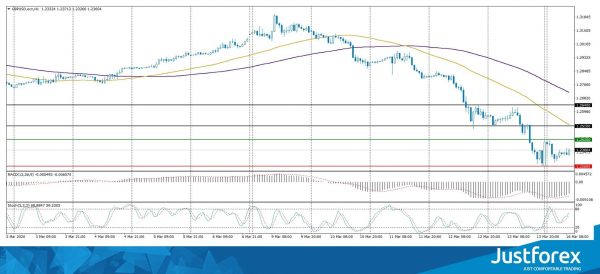

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.25656

Open: 1.24085

% chg. over the last day: -1.02

Day’s range: 1.22849 – 1.24212

52 wk range: 1.1959 – 1.3516

GBP/USD quotes continue to show negative dynamics. Sterling reached its six-month low. At the moment the trading instrument is consolidating. The local support and resistance levels are 1.22600 and 1.24250, respectively. The technical correction of GBP/USD currency pair is not excluded in the nearest future. We recommend you to monitor the current information about the COVID-19 virus spread. Open positions from key levels.

The news background on the UK economy is calm.

The indicators signal the sellers’ strength: the price has fixed below 50 MA and 100 MA.

The MACD histogram is in the negative zone, which indicates a bearish sentiment.

The Stochastic Oscillator is in the neutral zone, the %K line is above the %D line, which indicates that the GBP/USD currency pair might correct.

Trading recommendations

Support levels: 1.22600, 1.22000

Resistance levels: 1.24250, 1.25100, 1.26400

If the price fixes above 1.24250, expect the quotes to correct toward 1.25500-1.26000.

Alternatively, the quotes could descend toward 1.22000.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.39172

Open: 1.37394

% chg. over the last day: -0.89

Day’s range: 1.37294 – 1.39098

52 wk range: 1.2949 – 1.3566

The USD/CAD currency pair is in sideways movement. There is no defined trend. At the moment local support and resistance levels are at 1.38400 and 1.39500, respectively. The CAD remains under pressure amid aggressive sales in the black gold market. Nevertheless, technical correction of the trading instrument after prolonged growth is not excluded in the nearest future. Open positions from key levels.

The Economic News Feed for 16.03.2020 is calm.

Indicators do not give accurate signals: the price tests 50 MA and 100 MA.

MACD histogram is near the 0 mark.

The Stochastic Oscillator is located in the overbought zone, the %K line is above the %D line, which gives a weak signal to buy USD/CAD.

Trading recommendations

Support levels: 1.38400, 1.37300, 1.36200

Resistance levels: 1.39500, 1.40000

If the price fixes above 1.39500, consider buying USD/CAD. The price will move toward 1.40500-1.41000.

Alternatively, the quotes could correct toward 1.37500-1.37000.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 104.733

Open: 107.304

% chg. over the last day: +3.13

Day’s range: 105.742 – 107.567

52 wk range: 101.19 – 112.41

The USD/JPY currency pair has moved up. The trading instrument reached key extremums. The Bank of Japan kept the interest rate on commercial banks’ deposits at the same level -0.1% per annum. The regulator announced an increase in stimulus measures in response to the spread of the epidemic. At the moment, the Safe Haven currency is consolidating in the range of 106,000-107,400. USD/JPY quotes have potential for further growth. Open positions from key levels.

The Economic News Feed for 16.03.2020 is calm.

The indicators signal the power of buyers: the price has fixed above 50 MA and 100 MA.

The MACD histogram is in the positive zone, but below the signal line, which gives a weak signal to buy USD/JPY.

The Stochastic Oscillator is in the neutral zone, the %K line is below the %D line, which indicates a bearish mood.

Trading recommendations

Support levels: 106.000, 104.500, 103.200

Resistance levels: 107.400, 108.400

If the price fixes above 107.400, expect further growth of USD/JPY quotes to 108.400-109.000.

Alternatively, the quotes could decline toward 105.000-104.000.