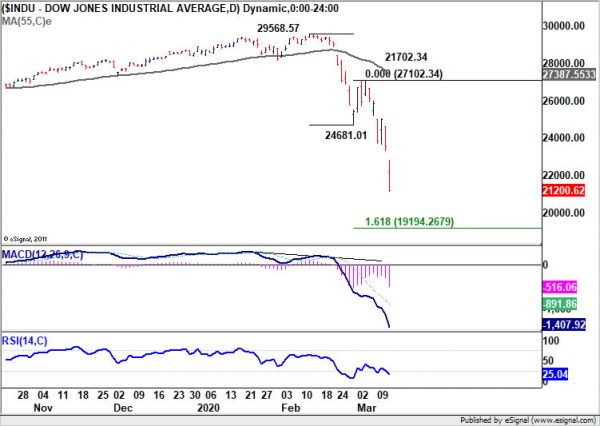

US stocks suffered the worst selloff since the history “Black Monday” crash in 1987 overnight. DOW closed down -2352.60 pts, or -9.99%. S&P 500 dropped -9.51% while NASDAQ dropped -9.43%. 10-year yield, however, rose 0.0239 to 0.849, extending the recovery from 0.398 made earlier this week.

After the massive selloff, DOW is now sitting inside an important long term support zone, between 55 month EMA and 38.2% retracement of 6469.95 to 29568.57 at 20744.89. It should be about the place to end the first leg of the correction for DOW to have a bounce.

Break of yesterday’s high of 23273.91, the lower end of the gap, would be the first sign of stabilization. The extent of the whole correction would very much depend on the strength and time of subsequent second leg consolidation.

However, firm break of 20744.89 will suggest something more serious is happening. In that case, the next near term target will be 161.8% projection of 29568.57 to 24681.01 from 21702.34 at 19194.26.