- ECB might not cut rates today – could introduce targeted lending measures and ramp up QE

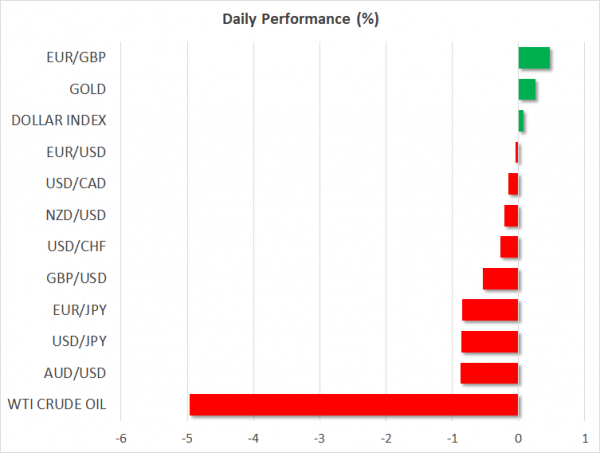

- Stocks plunge, oil retreats after Trump bans all travel from Europe

- Yen back in vogue, but gold doesn’t get the memo

- Dollar holds firm despite risk aversion, reclaiming safe-haven status

ECB may disappoint markets today, push euro briefly higher

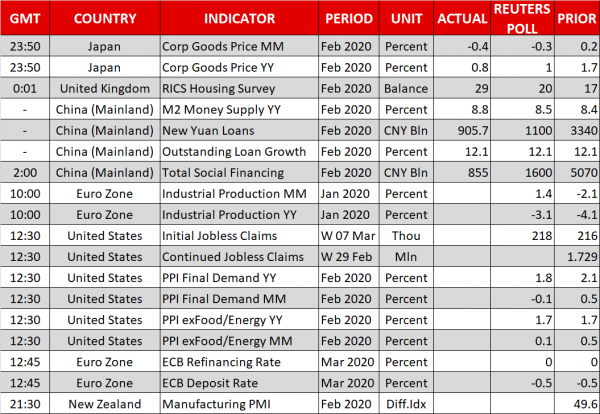

The European Central Bank (ECB) will have a tough balancing act on its hands when it announces it policy decision at 12:45 GMT today. On the one hand, it has to deliver something substantial enough to calm the nerves of jittery investors, who have spent the last few days reading chilling headlines about the state of affairs in Italy.

On the other hand, cutting rates won’t do much to negate a shock like this virus, if consumers are frightened enough to stay home. And with rates deep in negative territory already, many ECB policymakers feel that doing more of the same might even prove counter-productive by damaging the bloc’s stressed banking sector.

Therefore, cutting rates deeper into negative territory may be a bridge too far for the divided ECB. Instead, the central bank could announce new ‘targeted’ operations to provide liquidity to small and medium sized firms that have been impacted by the virus, helping them survive via ultra-cheap loans. It might also assist bigger companies by temporarily increasing its purchases of corporate bonds through its QE programme.

For the euro though, what matters most is whether rates will be slashed or not. Markets are currently fully pricing in a 10 basis-points (bp) rate cut and also assign a 30% probability for a bigger 20bp cut, so if the ECB indeed keeps rates unchanged today, euro/dollar would probably spike higher.

Having said that, it’s becoming difficult to envisage a sustained rally in euro/dollar from here (see below).

Trump lifts yen, torpedoes stocks after EU travel ban

Financial markets remain in absolute chaos as virus concerns run rampant. US stocks lost 5% on Wednesday and futures point to another 5% plunge when Wall Street opens today, after President Trump announced overnight that he will ban all travel from Europe for the next month in an attempt to slow the spread of the virus.

European stocks didn’t escape the carnage, with most indices down ~6% today not just on concerns of business disruptions due to the travel ban, but also due to an increasingly worrisome flow of European news. Italy closed down most of its stores yesterday, while one country after another is closing down schools and banning public events.

The Japanese yen shined bright amid the heightened risk aversion, though strangely enough, gold prices struggled for altitude. Amid this ‘perfect storm’ of fear, falling interest rates globally, and a softer dollar, one would have expected gold to smash through everything.

However, it seems that with stock markets cratering, investors might be liquidating profitable gold positions to cover their margin calls, which isn’t allowing bullion to gain traction. In other words, this may a case of ‘sell whatever you can to stay in the game’. The bigger picture therefore still looks favorable, particularly in a world of negative-yielding bonds and a rampaging pandemic.

Dollar won’t stay down – is the carry unwinding over?

Even though the greenback was behaving like a ‘risk on’ currency in recent weeks, that might be changing. The world’s reserve currency seems to be turning back into a safe haven, gaining ground yesterday despite the severe risk aversion and markets pricing in more and more Fed easing, with a 100bp rate cut now fully discounted for next week.

What gives? The latest wave of dollar losses was owed 1) to several carry trades being unwound as the risk mood soured, returning money to the Eurozone and 2) to the Fed cutting rates aggressively, wiping out the dollar’s rate advantage.

Both processes may have largely run their course. Hence, even though euro/dollar could spike higher today if the ECB doesn’t cut rates, the overall outlook appears negative. Both the Eurozone and the US will be hit hard, but America’s economy is starting at a much stronger point and with powerful stimulus to help it counter the impact, whereas Europe may be facing the risk of a recession soon with little stimulus room to speak of.