Dollar index continues to hover around 10 month low as the greenback stays generally weak, except versus Sterling. Treasury yields also extended recent pull back overnight. 10 year yield dropped -0.046 to close at 2.263, comparing to this month’s high at 2.396. Markets saw the collapse of the second healthcare bill in US Senate as another sign of US President Trump’s failure in pushing through his agenda. And it’s doubtful when Trump would finally start working his pro-growth policies, including tax reforms, through the Congress. On the other hand, stocks were resilient on receding expectation of more policy tightening by Fed. Indeed, both NASDAQ and S&P 500 closed at record highs at 6344.31 and 2460.61 respectively.

Sterling maintains post CPI losses

Meanwhile, Sterling remains broadly weak after suffering deep selloff from CPI miss. BoE Governor Mark Carney said that the "big picture" of inflation remained the same even though CPI slowed from 2.9% yoy to 2.6% yoy in June. He also noted that the main driver of inflation is depreciation of the Pound. And, "that’s what’s pushing inflation up, and inflation will be above target for a period of time and today’s figures are consistent with that." BoE hawks, on the other hand, have been saying that the driver of inflation has fundamentally changed. The debate between MPC members will continuing in the coming months. But for now, it’s unlikely that more members would turn hawkish and vote for a hike.

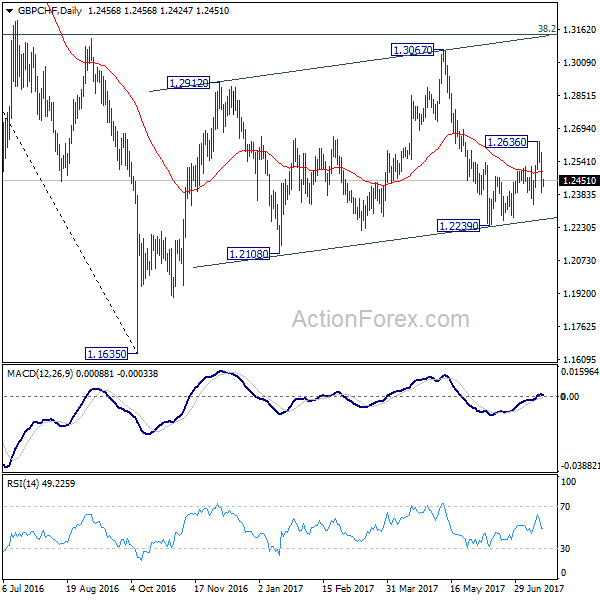

GBP/CHF is one of the biggest movers this week on selloff of Sterling. The development now argues that choppy rise from 1.2239 is a corrective move and could have completed at 1.2636. Deeper fall might now be seen back to 1.2239. Break there would extend the whole decline from 1.3067 and would target a test on 1.1635 low. As GBP/CHF, is limited below long term fibonacci level of 38.2% retracement of 1.5570 to 1.1635 at 1.3138. Price actions from 1.1635 also look corrective. Medium term outlook stays bearish for extending the down trend from 1.5570.

Euro firm ahead of ECB

Euro is, on the other hand, relatively firm as markets await ECB rate decision and press conference on Thursday. It’s reported that ECB staff are looking at scenarios of future policy path and decisions could be made in September. The details might include the path tapering, extension of asset purchase as a slow pace, or a combination. There is no solid proposal for the moment and ECB policy makers are unlikely to change the language to signal a policy shift yet. Yet, it should be consensus that the central bank has to take the shift very carefully. Recent comments from ECB President Mario Draghi has also shot up the Euro and yields in Eurozone, that pushed global yields much higher.

Accord to a quarterly survey by ECB, banks in the region are set to expand lending in Q3. ECB said that "while most factors contributed to a net easing of credit standards on loans to enterprises in the second quarter of 2017, competitive pressure remained the main contributing factor." And, "for loans to households for house purchase and for consumer credit and other lending to households, competitive pressure and risk perceptions had an easing impact on credit standards."

Markets look into BoJ board shuffle

BoJ will also announce policy decision later in the week. While no change is expected by the central bank, the markets are eager to see how the reshuffle in the board would shape the balance. New member Goushi Kataoka is a known dove who advocate massive stimulus. He wrote in a research note at Mitsubishi UFJ Research and Consulting earlier this year that "full-blown monetary and fiscal policies coupled with a growth strategy are crucial to break completely out of prolonged economic stagnation." Another new member Hitoshi Suzuki is believed to be a neutral. On the other hand, the usual dissenters Takehiro Sato and Takahide Kiuchi left.

Light day ahead

On the data front, Australia Westpac leading index dropped -0.1% mom in June. Canada will release manufacturing shipments today. US will release housing starts and building permits.

USD/CAD Daily Outlook

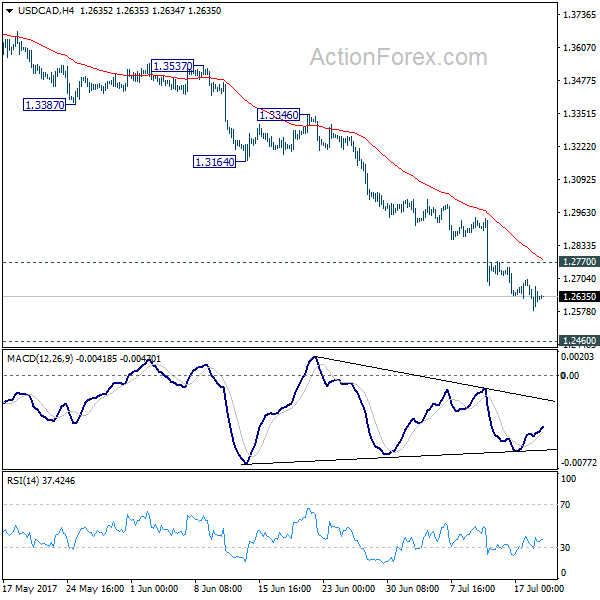

Daily Pivots: (S1) 1.2571; (P) 1.2636; (R1) 1.2692; More….

USD/CAD continues to lose downside momentum as seen in 4 hour MACD. But there is no sign of bottoming yet. Intraday bias stays on the downside. Current decline from 1.3793 should target a test on 1.2460 low next. Meanwhile, considering bullish convergence condition in 4 hour MACD, break of 1.2770 will indicate short term bottoming In such case, there will be lengthier consolidation before staging another decline.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. Fall from 1.3793 is seen as the third leg and should target 50% retracement of 0.9406 to 1.4869 at 1.2048. At this point, we’d look for strong support from there to contain downside and bring rebound. However, firm break there will target 100% projection of 1.4689 to 1.2460 from 1.3793 at 1.1564.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | Westpac Leading Index M/M Jun | -0.10% | 0.00% | ||

| 12:30 | CAD | Manufacturing Shipments M/M May | 0.70% | 1.10% | ||

| 12:30 | USD | Housing Starts Jun | 1.16M | 1.09M | ||

| 12:30 | USD | Building Permits Jun | 1.20M | 1.17M | ||

| 14:30 | USD | Crude Oil Inventories | -7.6M |