Dollar tumbles sharply as two Republicans senators announced their rejection of the US President Donald Trump’s health care bill. The current version is short of at least two votes to advance and is seen as effectively dead by analysts. The development will further delay the work on tax and fiscal reforms, which are scheduled to come after health care. Markets continue to questioned the ability of Trump on pushing through his economic agenda and delivering his election promises. That adds to doubt of whether the economy could sustain another rate hike by Fed this year. Meanwhile, New Zealand Dollar follows as the second weakest currency after lower than expected CPI reading. On the other hand, Australian Dollar leads other currencies high as boosted by hawkish RBA minutes.

Two more Senate Republicans opposed to Trump’s health care bill

In US, Republican senators Mike Lee of Utah and Jerry Moran of Kansas announced their opposition to Trump’s heath care bill, which aimed at repealing the Affordable Care Act, known as Obamacare. Lee said in his statement that "in addition to not repealing all of the Obamacare taxes, it doesn’t go far enough in lowering the premiums for middle-class families; nor does it create enough free space fro the most costly Obamacare regulations". Moran said that "we should not put our stamp of approval on bad policy" and he criticized that the health care bill was written with a "closed-door process" and the Senate must start the bill fresh with open debates.

Two other Republican senators have already voiced their objections, including Rand Paul of Kentucky and Susan Collins of Maine. That left Majority Leader Mitch McConnell’s proposal two votes short of advancing. And some analysts see the proposal as effectively dead. It’s unknown what Trump would do next to push the health care reform but he tweeted that "republicans should just REPEAL failing ObamaCare now & work on a new Healthcare Plan that will start from a clean slate. Dems will join in!" At the same time, markets are clearly dissatisfied with the progress of Trump’s work and remain doubtful on when and even whether he is able to push through the promised tax reforms and fiscal policies.

RBA minutes: 3.5% could be the appropriate neutral rate

RBA minutes for the July meeting suggested that policymakers acknowledged the economic growth and the improvement in the labor market recently. The members also discussed the appropriate neutral rate which they believed should be at 3.5%, well above the current cash rate of 1.5%. This heightened market expectations of a potential rate hike in the near-term. As such, Aussie jumped to a 2-year high after the release of the minutes. More in Speculations Of RBA Rate Hike Heightened, As Members Discussed Neutral Rate.

Kiwi plummets as CPI affirmed RBNZ’s neutral stance

New Zealand Dollar tumbles sharply after weaker than expected inflation data. Over the quarter, CPI rose 0.0% qoq, down from prior quarter’s 1.0% qoq and missed expectation of 0.2% qoq. Annually, CPI slowed to 1.7% yoy, down from 2.2% yoy and missed expectation of 1.9% yoy. The reading now clearly support RBNZ’s neutral stance. There were some questions and disappointment as RBNZ didn’t turn hawkish after CPI shoot to 2.2% yoy back in Q1. But now it’s obvious that the central bank has made the correct decision.

ETF purchases questioned ahead of BoJ meeting

Ahead of BoJ meeting later this week, there are reports that some officials are concerned with the sustainability of ETFs as part of the asset purchase program. The JPY 6T annual purchase of ETFs is subject of continued questioning. In particular, the central bank is already owning more than 70% of all shares in Japan-listed ETFs at the end of June. And there were criticism that such purchase is artificially driving the rise in stocks, yet it’s unsure how this would help drive inflation up. But overall, BoJ is not expected to announce any change in monetary policy this week. Meanwhile, the central bank is expected to lower inflation projections and raise growth projections.

UK CPI to watch today

UK inflation data will be a key to watch in European session today. Headline CPI is expected to be unchanged at 2.9% yoy in June while core CPI is expected to say at 2.6% yoy. Much volatility is seen in Sterling recently, in particular in crosses. The hawkish turn in BoE Governor Mark Carney raised the hope of a rate hike by the central bank in near term. But such expectation was dented by a string of weaker than expected sentiment and growth data. The key will lie in inflation and more MPC member would turn to the hawk camp should CPI surprises to the upside today and show little sign of topping soon. Also to be released from UK are RPI, PPI and house price index. Elsewhere, Germany will release ZEW economic sentiments, US will release import price index and NAHB housing market index.

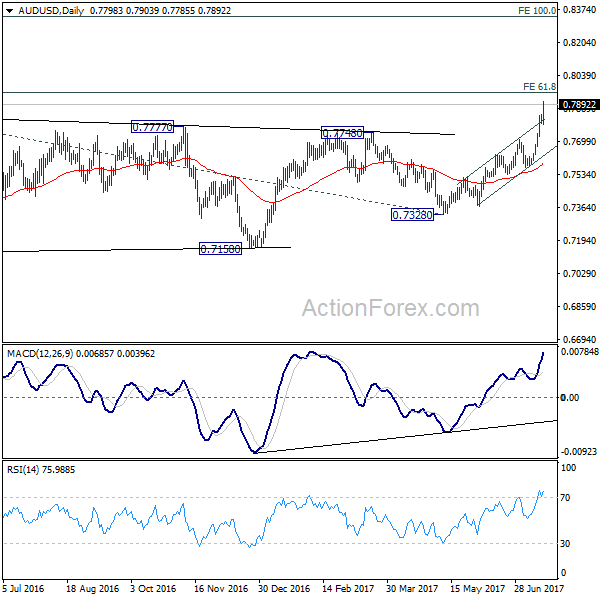

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7780; (P) 0.7809; (R1) 0.7826; More…

AUD/USD’s rise resumed after brief consolidation and reaches as high as 0.7903 so far. The break of near term channel resistance indicates upside acceleration. Intraday bias stays on the upside for 61.8% projection of 0.6826 to 0.7833 from 0.7328 at 0.7950 next. Break there will target 100% projection at 0.8335. On the downside, below 0.7785 will turn intraday bias neutral and bring consolidations before staging another rally.

In the bigger picture, current development suggests that rebound from 0.6826 is developing into a medium term rise. There is no confirmation of trend reversal yet and we’ll continue to treat such rebound as a corrective pattern. But in any case, further rise is now expected to 55 month EMA (now at 0.8100) or even further to 38.2% retracement of 1.1079 to 0.6826 at 0.8451. Break of 0.7328 support is needed to confirm completion of the rebound. Otherwise, further rise is now expected.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | CPI Q/Q Q2 | 0.00% | 0.20% | 1.00% | |

| 22:45 | NZD | CPI Y/Y Q2 | 1.70% | 1.90% | 2.20% | |

| 1:30 | AUD | RBA Minutes July | ||||

| 8:30 | GBP | CPI M/M Jun | 0.20% | 0.30% | ||

| 8:30 | GBP | CPI Y/Y Jun | 2.90% | 2.90% | ||

| 8:30 | GBP | Core CPI Y/Y Jun | 2.60% | 2.60% | ||

| 8:30 | GBP | RPI M/M Jun | 0.40% | 0.40% | ||

| 8:30 | GBP | RPI Y/Y Jun | 3.60% | 3.70% | ||

| 8:30 | GBP | PPI Input M/M Jun | -0.90% | -1.30% | ||

| 8:30 | GBP | PPI Input Y/Y Jun | 9.30% | 11.60% | ||

| 8:30 | GBP | PPI Output M/M Jun | 0.10% | 0.10% | ||

| 8:30 | GBP | PPI Output Y/Y Jun | 3.40% | 3.60% | ||

| 8:30 | GBP | PPI Output Core M/M Jun | 0.10% | 0.10% | ||

| 8:30 | GBP | PPI Output Core Y/Y Jun | 2.80% | 2.80% | ||

| 8:30 | GBP | House Price Index Y/Y May | 3.00% | 5.60% | ||

| 9:00 | EUR | German ZEW (Economic Sentiment) Jul | 18 | 18.6 | ||

| 9:00 | EUR | German ZEW (Current Situation) Jul | 88 | 88 | ||

| 9:00 | EUR | Eurozone ZEW (Economic Sentiment) Jul | 37.2 | 37.7 | ||

| 12:30 | USD | Import Price Index M/M Jun | -0.20% | -0.30% | ||

| 14:00 | USD | NAHB Housing Market Index Jul | 67 | 67 | ||

| 20:00 | USD | Net Long-term TIC Flows May | 20.3B | 1.8B |