US stocks staged a massive rebound overnight, with DOW closed up over 5%. But reactions in other markets are muted. Strength in Asian markets is very limited even though major indices are in black. Gold is gyrating in tight range around 1600 handle. WTI crude oil struggles to gain momentum above 48. In the currency markets, Australian Dollar is mixed, shrugging off RBA’s expected rate cut. Major pairs and crosses are staying inside Monday’s range, with Euro and Swiss Franc staying firmest.

Technically, AUD/USD and AUD/JPY are staying in consolidation after RBA’s move. Outlook in both pairs remains bearish and we’d expect recovery to be limited below 0.6662 and 72.41 resistance respectively. Down trends are expected to resume sooner or later. 1.1239 resistance in EUR/USD will remain a major focus for the week. Decisive break there will at least confirm medium term bottoming at 1.0777. Near term outlook will be turned bullish for stronger rebound to 1.1456 fibonacci level.

In Asia, currently, Nikkei is up 0.16%. Hong Kong HSI is up 0.78%. China Shanghai SSE is up 1.36%. Singapore Strait Times is up 1.03%. 10-year JGB yield is up 0.0304 at -0.106. Overnight, DOW rose 5.09%. S&P 500 rose 4.60%. NASDAQ rose 4.49%. 10-year dropped -0.039 to 1.088, another record low.

Global coronavirus surge, G7 to consider concerted actions

New cases of coronavirus in China continued to slow. According to the National Health Commission, there were only 125 new confirmed cases on March 2, lowest since data being published in January. Excluding the epicenter of Hubei province, there were only 11 news cases. Total accumulated cases stands at 8015. Death toll rose 31 to 2943.

Outbreak elsewhere shows no signs of slowing,however. South Korea added 477 cases and total at 4812, with 6 new deaths to 34. Italy now stands at 2036, with 52 deaths. Iran stands at 1501, with 66 deaths. Japan is relatively steady at 274 with 6 deaths. Numbers in Europe are surging, however, with France at 191 and 3 deaths, Germany at 165 and Spain at 120. USA at 103 might soon take over Singapore’s 108. Hong Kong stands steady at 100.

French Finance Minister Bruno Le Maire said on Monday that G7 countries will take “concerted action” to limit the economic impact of the coronavirus outbreak. He told France 2 television, “There will be a concerted action. Yesterday I spoke with the G7 president, the U.S. Treasury Secretary Steven Mnuchin, and this week we will have a meeting by phone of the finance G7 ministers to coordinate our responses.”

RBA cut to 0.50% in response to global coronavirus outbreak, maintains easing bias

RBA cut cash rate by -25bps to 0.50% in an act to “support the economy as it responds to the global coronavirus outbreak.” It noted that global growth in H1 will be “lower than earlier expected” due to the coronavirus and it’s “too early to tell how persistent the effects” will be.

For Australian economy, the outbreak overseas is “having a significant effect”, particularly in “education and travel sectors”. The uncertainty is “likely to affect domestic spending too”. Q1 GDP is “likely to be noticeably weaker than earlier expected”. Though, once the coronavirus is contained, Australian economy is “expected to return to an improving trend”.

The outbreak is expected to “delay progress” towards full employment and inflation target. RBA maintains easing bias and “the Board is prepared to ease monetary policy further to support the Australian economy.”

Australia Morrison: This coronavirus health crisis is different from a global financial crisis

Australian Prime Minister Scott Morrison said the economic impact of coronavirus outbreak is complete different to those of the global financial crisis. “This health crisis – with economic, significant economic implications – is different from a global financial crisis.”

“This is a health crisis which has had serious disruptive impact on … the movement of people, and of goods around the world. That obviously disrupts supply chains and has a suppressing impact on demand,” he added.

“It is a very different set of economic circumstances and issues we are seeking to address. The most important thing is the cashflow, particularly of more vulnerable small- and medium-sized enterprises; the workers – those who work for those businesses – and ensuring that they are in a position to be there on the other side when the economy bounces back.”

He said the Treasury is working through the details of a “targeted”, “measured” and “scalable” fiscal plan. The plan will be ” targeted on the real diagnosis of the economic issue we are looking to confront here.”

ECB Lagarde ready to take appropriate and targeted measures against coronavirus impact

ECB President Christine Lagarde said in an emergency statement that “the coronavirus outbreak is a fast developing situation, which creates risks for the economic outlook and the functioning of financial markets.”

“The ECB is closely monitoring developments and their implications for the economy, medium-term inflation and the transmission of our monetary policy. We stand ready to take appropriate and targeted measures, as necessary and commensurate with the underlying risks.”

Japan Abe: We’ve already compiled a spending package to forestall various risks

Japan Prime Minister Shinzo Abe said today that the government is ready to implement further stimulus measures to offset the impact from coronavirus outbreak. He noted, “we’ve already compiled a spending package to forestall various risks” in the supplementary budget.

“We’ll scrutinize the impact of the coronavirus on the global and Japanese economies. If further steps are deemed necessary, we will take action without hesitation,” he added.

On the data front

Japan monetary base rose 3.6% yoy in February versus expectation of 3.2% yoy. Australia current account surplus narrowed to AUD 1.0B in Q4 versus expectation of AUD 2.3B. Building permits dropped -15.3% mom in January, much worse than expectation of 1.0% mom.

Looking ahead, Swiss will release Q4 GDP. UK will release construction PMI. Eurozone will release unemployment rate, CPI flash and PPI.

AUD/USD Daily Report

Daily Pivots: (S1) 0.6484; (P) 0.6526; (R1) 0.6584; More….

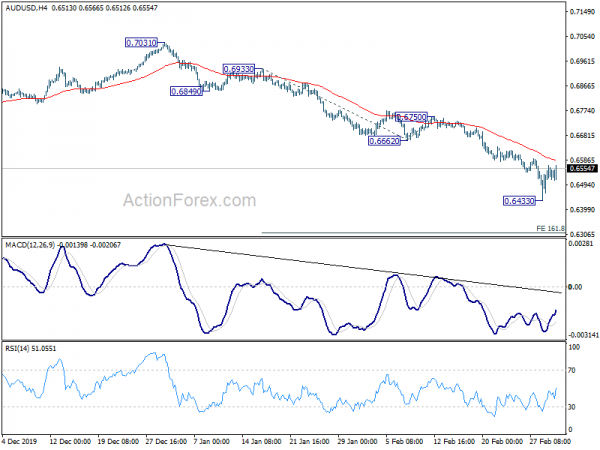

AUD/USD is staying in consolidation from 0.6433 temporary low and intraday bias remains neutral first. Upside of recovery should be limited below 0.6662 support turned resistance to bring fall resumption. On the downside, break of 0.6433 will turn bias to the downside for 161.8% projection of 0.6933 to 0.6662 from 0.6750 at 0.6312.

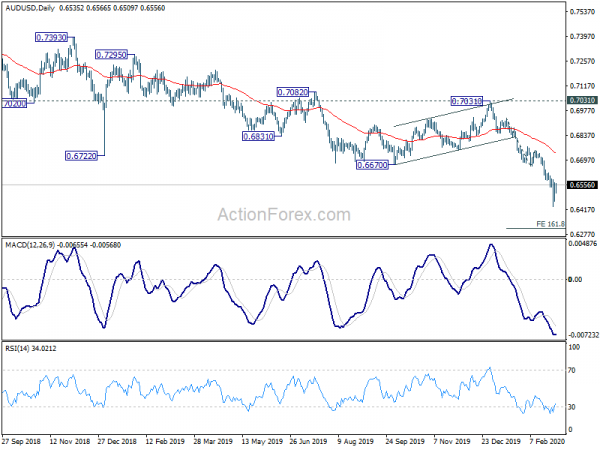

In the bigger picture, AUD/USD’s decline from 0.8135 (2018 high) is still in progress. It’s part of the larger down trend from 1.1079 (2011 high). Rejection by 55 week EMA affirms medium term bearishness. Next target is 0.6008 (2008 low). Outlook will stay bearish as long as 0.7031 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Feb | 3.60% | 3.20% | 2.90% | |

| 0:30 | AUD | Current Account Balance (AUD) Q4 | 1.0B | 2.3B | 7.9B | 6.5B |

| 0:30 | AUD | Building Permits M/M Jan | -15.30% | 1.00% | -0.20% | 3.90% |

| 3:30 | AUD | RBA Rate Decision | 0.50% | 0.50% | 0.75% | |

| 3:30 | AUD | RBA Rate Statement | ||||

| 5:00 | JPY | Consumer Confidence Index Feb | 38.4 | 39.1 | ||

| 6:45 | CHF | GDP Q/Q Q4 | 0.20% | 0.40% | ||

| 9:00 | EUR | Italy Unemployment Jan | 9.80% | 9.80% | ||

| 9:30 | GBP | Construction PMI Feb | 49 | 48.4 | ||

| 10:00 | EUR | Eurozone Unemployment Rate Jan | 7.40% | 7.40% | ||

| 10:00 | EUR | CPI Y/Y Feb P | 1.20% | 1.40% | ||

| 10:00 | EUR | CPI Core Y/Y Feb P | 1.10% | 1.10% | ||

| 10:00 | EUR | PPI M/M Jan | 0.20% | 0.00% | ||

| 10:00 | EUR | PPI Y/Y Jan | -0.50% | -0.70% |