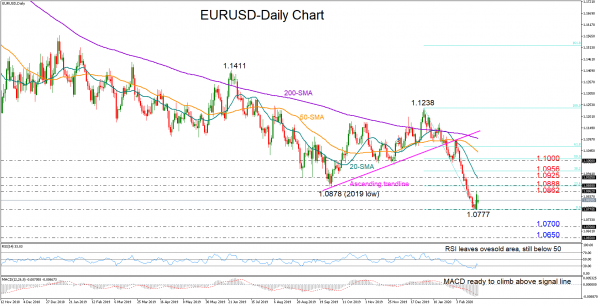

EURUSD finally found some footing around a 34-month low of 1.0777 last week following the heavy sell-off from the beginning of the month, with the price strengthening towards the 1.0800 territory on Friday.

The rebound, however, has not convinced traders yet that it is long lasting as the price could not clear the 1.0862-1.0888 resistance area that kept the bulls under control last week. This is also where the 23.6% Fibonacci of the downleg from 1.1238 to 1.0777 is located.

Technically, the pair could hold above its recent troughs in the short-term and attempt to break the aforementioned ceiling given the reversal in the RSI and the MACD. Should efforts prove successful, the rally may next pause within the 1.0925-1.0953 region formed by the 20-day simple moving average (SMA) and the 38.2% Fibonacci. Any further improvement could then open the door for the 1.1000 level and the 50% Fibonacci.

In the negative scenario, the 1.0777 bottom could come under the spotlight again if the bulls fail to close comfortably above 1.0888. Any leg lower may shift support towards the 1.0700-1.0650 restrictive zone last seen in the 2016-2017 period.

In the medium-term picture, the pair is likely to keep a downward direction as long as it trades below 1.0888.

Summarizing, EURUSD is expected to hold neutral in the short-term unless it overcomes the wall the 1.0867-1.0888 wall.