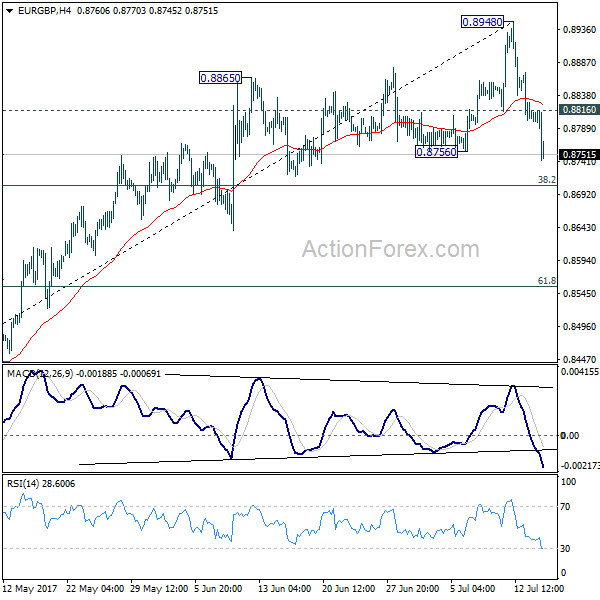

EUR/GBP surged to 0.8948 initially last week but reversed from there. Break of near term rising channel and 0.8756 support argues that rise from 0.8312 has completed, on bearish divergence condition in 4 hour MACD. Initial bias is now on the downside this week for 38.2% retracement of 0.8312 to 0.8948 at 0.8705 first. Break will target 61.8% retracement at 0.8555 next. On the upside, above 0.8816 minor support will turn intraday bias neutral and bring recovery. But deeper decline is now in favor as long as 0.8948 resistance holds.

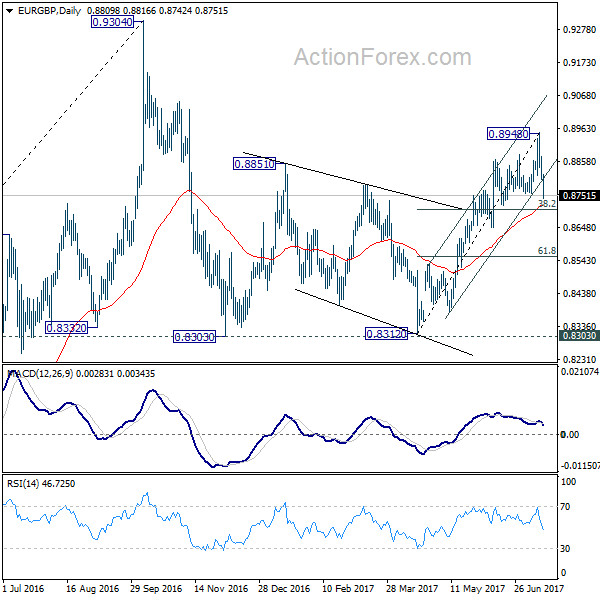

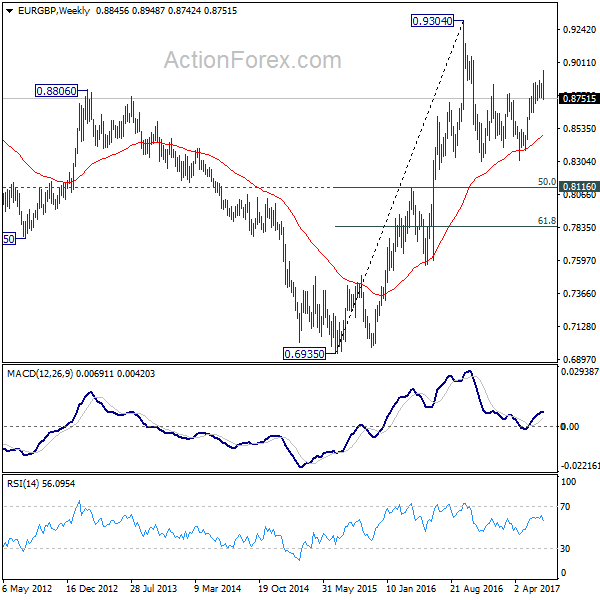

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s uncertain whether it is finished yet. But in case of another fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes.

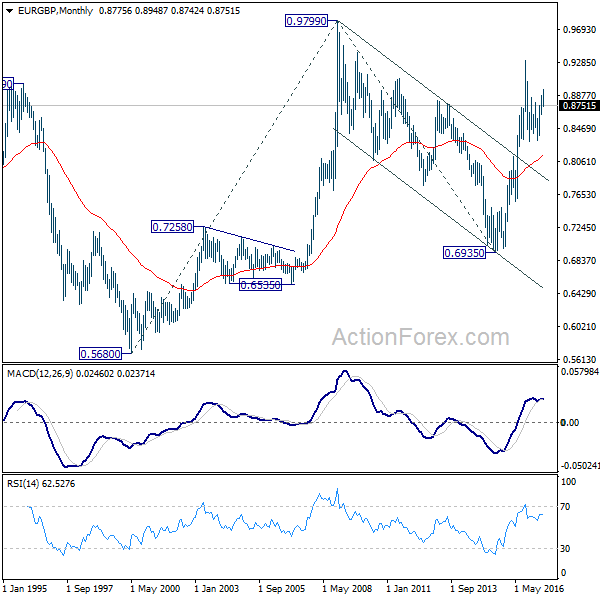

In the long term picture, firstly, price action from 0.9799 (2008 high) is seen as a long term corrective pattern and should have completed at 0.6935 (2015 low). Secondly, rise from 0.6935 is likely resuming up trend from 0.5680 (2000 low). Thirdly, this is supported by the impulsive structure of the rise from 0.6935 to 0.9304. Hence, after the correction from 0.9304 completes, we’d expect another medium term up trend to target 0.9799 high and above.