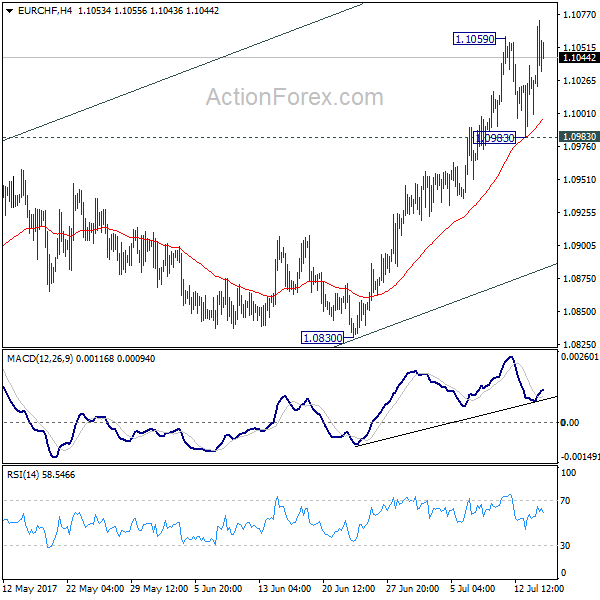

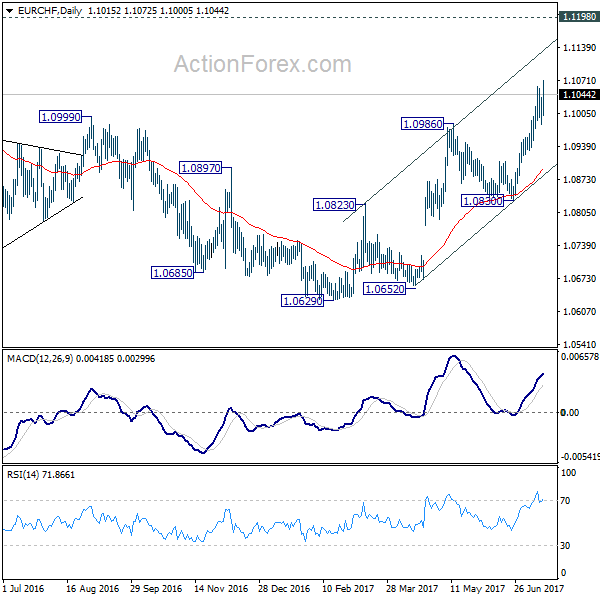

EUR/CHF surged to as high as 1.1072 last week and the development confirmed resumption of whole rally from 1.0629. Initial bias remains on the upside this week for key resistance at 1.1127/98. On the downside, break of 1.0983 support is needed to indicate short term topping. Otherwise, outlook will remain bullish in case of retreat.

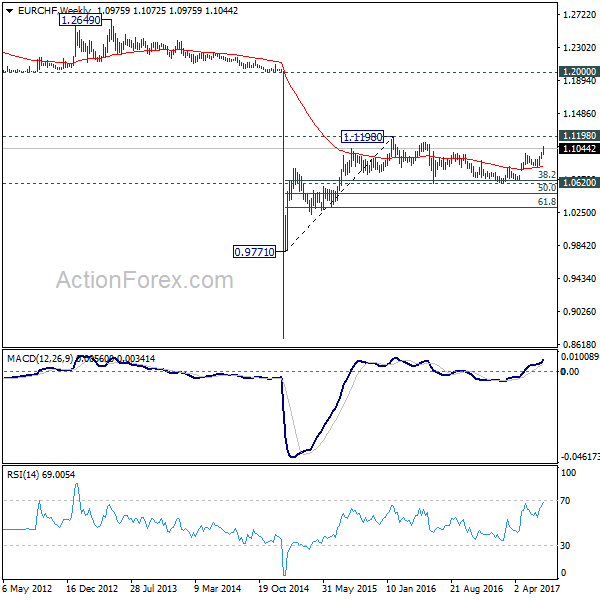

In the bigger picture, the price actions from 1.1198 are seen as a corrective move. Such correction could have completed after defending 38.2% retracement of 0.9771 to 1.1198 at 1.0653. Decisive break of 1.1198 will resume the long term rise from SNB spike low back in 2015. In such case, EUR/CHF could eventually head back to prior SNB imposed floor at 1.2000. However, rejection from 1.1198 will extend the multi-year range trading with another fall.