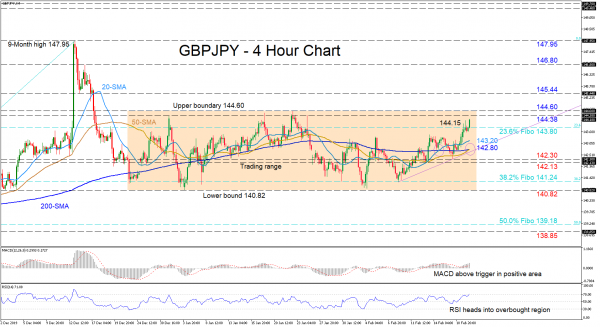

GBPJPY is currently improving off the 143.80 level, which is the 23.6% Fibonacci retracement of the up move from 130.42 to 147.95. The near completion of the bullish crossover of the 200-period simple moving average (SMA) by the 50-period one seems to have further aided in the very short-term incline from February 10 that bounced off the 38.2% Fibo of 141.24.

Looking at the short-term oscillators, they suggest a pickup in positive sentiment. The MACD, in the positive zone, is increasing above its red trigger line, while the rising RSI has moved into the overbought territory.

To the upside, closing above the fresh high of 144.15, immediate resistance could come from the area of upper boundaries from 144.38 to 144.60. Breaking above the two-month horizontal pattern, the following hurdle to the ascent may come at the inside swing low of 145.44 from December 13. Overtaking this, the 146.80 peak may be next to impede buyers from reaching the nine-month peak of 147.95.

Alternatively, if sellers steer below the 23.6% Fibo of 143.80, the 20-period SMA at 143.20 could provide some hindrance ahead of a support area around 142.80, where the bullish crossover of the 200-period SMA and a possible trendline reside. Moving past the 142.80 mark, the 142.30 and 142.13 lows could prevent the pair from dropping to the 38.2% Fibo of 141.24. Penetrating below this, the lower boundary of the range of 140.82 could halt further loss of ground towards the 50.0% Fibo of 139.18 and the 138.85 support underneath.

Overall, the short-term bias is still neutral, despite the near-term improvement. Yet, a break above 144.60 or below 140.82 would be required to reveal the next direction.