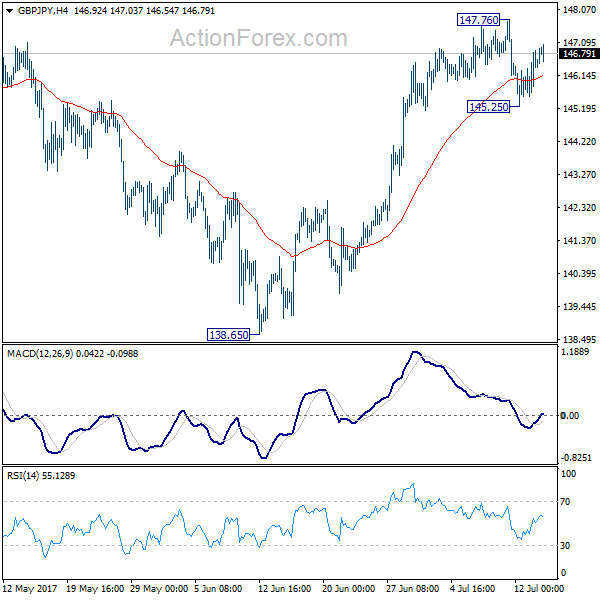

Daily Pivots: (S1) 145.79; (P) 146.33; (R1) 147.12; More

Intraday bias in GBP/JPY is turned neutral with the current recovery. But still, as short term top is formed at 147.76, deeper decline is in favor. Below 145.25 will turn bias to the downside for 55 day EMA (now at 143.70). Break there will target 135.58 key support level again. On the upside, though, decisive break of 148.09/42 will pave the way to long term fibonacci level at 150.43.

In the bigger picture, rise from medium term bottom at 122.36 is expected to continue to 38.2% retracement of 196.85 to 122.36 at 150.43. Decisive break there will carry long term bullish implications and pave the way to 61.8% retracement at 167.78. In case the sideway pattern from 148.42 extends, we’d be looking for strong support from 135.58 and 50% retracement of 122.36 to 148.42 at 135.39 to contain downside.