Markets continue to stay in risk on mode today, with US futures point to more record highs. There is some lift by news that China will halve tariffs on some US imports. Also coronavirus continues to be off investors’ mind. In the currency markets, Australian Dollar is the strongest one for today, followed by Euro and then Dollar. Sterling is the weakest, followed by Canadian. For the week, commodity currency are the strongest, as led by Aussie. Sterling is the weakest, followed by Yen and Franc.

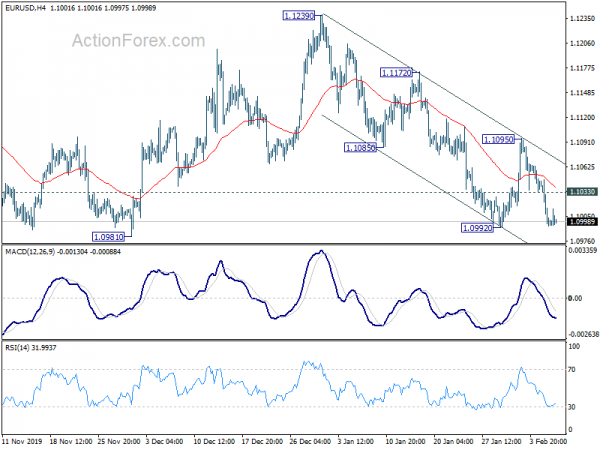

Technically, EUR/USD stabilizes just ahead of 1.0992 support. But recovery so far is very weak and further fall is in favor. Break of 1.0992 will reaffirm the case that corrective rise from 1.0879 has completed with three waves up from 1.1239. Retest of 1.0879 low should be seen next. On the other hand, EUR/JPY’s recovery seems to be losing some momentum ahead of 121.26 minor resistance. Rejection of this resistance will maintain near term bearishness for extending the fall from 122.87 through 119.77 ahead.

In Europe, FTSE is currently up 0.37%. DAX is up 0.64%. CAC is up 0.75%. German 10-year yield is up 0.0109 at -0.346. Earlier in Asia, Nikkei rose 2.38%. Hong Kong HSI is up 2.64%. China Shanghai SSE is up 1.72%. Singapore Strait Times is up 0.98%. Japan 10-year JGB yield rose 0.0177 to -0.015.

US initial jobless claims dropped to 202k, non-farm productivity rose 1.4%

US initial jobless claims dropped -15k to 202k in the week ending February 1, below expectation of 210k. Four-week moving average of initial claims dropped -3k to 211.75k. Continuing claims rose 48k to 1.751m in the week ending January 25. Four-week moving average of continuing claims dropped -13.25k to 1.742m.

Non-farm productivity rose 1.4% in Q4, matched expectations. Unit labor costs rose 1.4%, above expectation of 0.9%.

ECB Lagarde: Eurozone economy continues to require monetary support to shield from global headwinds

At a European Parliament committee hearing, ECB President Christine Lagarde said that “the legacy of the financial crisis have driven interest rates down”. Such “low interest rate and low inflation environment has significantly reduced the scope for the ECB and other central banks worldwide to ease monetary policy in the face of an economic downturn”. There were also structural challenges like “environmental sustainability, rapid digitalisation, globalisation and evolving financial structures”. Hence, it’s the “appropriate time” to conduct the policy strategy review.

On the economy , she said there are “tentative signs of stabilisation” in the global economy but uncertainty surrounding the impact of the coronavirus is a “renewed source of concern”. Overall moderate growth performance is “pass-through from wage increases to prices” and inflation remain subdued. Hence, the Eurozone economy “continues to require support from our monetary policy, which provides a shield from global headwinds.”

ECB Monthly Bulletin basically echoes Lagarde’s comments. It noted that Eurozone expansion will continue to be supported by “favourable financing conditions”. Risks remain “titled to the downside” in Eurozone due to ” geopolitical factors, rising protectionism and vulnerabilities in emerging market economies”. But the risks have “become what less pronounced”.

BoJ Masai: Global economy to rebound through the first half of 2020

BoJ board member Takako Masai said that global economy is on track for a rebound “through the first half of 2020,” as “there seems to be signs of recovery in the manufacturing sector”. Though, China’s coronavirus outbreak is among risks to global economy and could hurt business sentiment.

For her, “it is still indispensable that Japan persistently continues with the current policy to overcome deflation completely.” And, “the BOJ will persistently devise measures considered necessary at the time,”

Regarding the risks from ultra-loose monetary policy, “if there are signs of disruption in financial intermediation, we will of course take necessary steps including those to make our stimulus program more sustainable.”

Australia retail sales dropped -0.5%, trade surplus narrowed to AUD 5.22B

Australia retail sales dropped -0.5% mom in December, worse than expectation of -0.2% mom. Though, that was not enough to offset November’s strong 1.0% mom rise. The following states and territories fell in seasonally adjusted terms in December 2019: New South Wales (-1.2%), Queensland (-0.5%), South Australia (-1.3%), the Northern Territory (-0.4%), and the Australian Capital Territory (-0.1%). Victoria (0.0%) and Western Australia (0.0%) were relatively unchanged, while Tasmania (1.1%) rose.

In seasonally adjusted terms, exports of goods and services rose AUD 557m to AUD 41.29B. Import of goods and services rose AUD 853m to AUD 36.07B. Trade surplus narrowed slightly to AUD 5.22B, smaller than expectation of AUD 5.60B.

Australia NAB business confidence unchanged at -1, more RBA support still needed

Australia NAB Business Confidence was unchanged at -1 in Q4. Current Business Conditions, improved from 2 to 4. However, Business Conditions for the next three months dropped from 10 to 9, for the next 12 months dropped from 20 to 16.

Alan Oster, NAB Group Chief Economist: “The survey broadly fits with our overall read of the economy. A weak private sector – particularly in the consumer space and only modest inflation pressure. There also appears some risk around the outlook for the labour market and business investment. We think more policy support is needed and that this is still likely to occur in 2020, but for now the RBA appears in wait and see mode with labour market conditions still faring well”.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.0979; (P) 1.1014; (R1) 1.1033; More…

Intraday bias in EUR/USD remains on the downside with focus on 1.0992 support. Decisive break there will resume the whole decline from 1.1239. Also, that would add to the case that corrective rebound from 1.0879 has completed at 1.1239. In this case, deeper decline would be seen back to retest 1.0879 low. On the upside, above 1.1033 minor resistance will turn intraday bias neutral first.

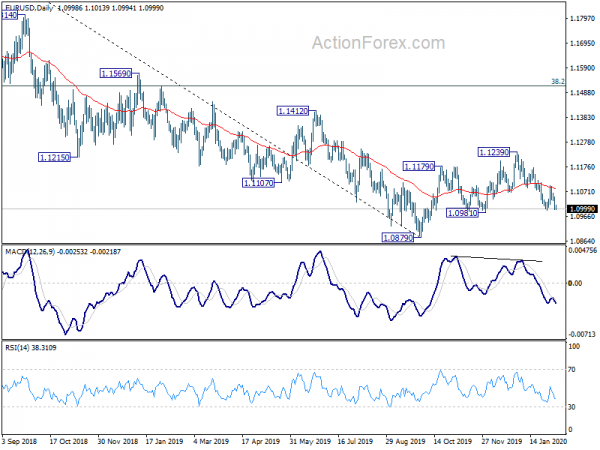

In the bigger picture, rebound from 1.0879 is seen as a corrective move at this point. In case of another rise, upside should be limited by 38.2% retracement of 1.2555 to 1.0879 at 1.1519. And, down trend from 1.2555 (2018 high) would resume at a later stage. However, sustained break of 1.1519 will dampen this bearish view and bring stronger rise to 61.8% retracement at 1.1915 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:30 | AUD | NAB Business Confidence Q4 | -1 | -2 | -1 | |

| 00:30 | AUD | Retail Sales M/M Dec | -0.50% | -0.20% | 0.90% | 1.00% |

| 00:30 | AUD | Trade Balance (AUD) Dec | 5.22B | 5.60B | 5.80B | 5.52B |

| 07:00 | EUR | Germany Factory Orders M/M Dec | -2.10% | 0.60% | -1.30% | -0.80% |

| 09:00 | EUR | ECB Economic Bulletin | ||||

| 12:30 | USD | Challenger Job Cuts Y/Y Jan | 27.80% | -25.20% | ||

| 13:30 | USD | Initial Jobless Claims (Jan 31) | 202K | 210K | 216K | 217K |

| 13:30 | USD | Nonfarm Productivity Q4 P | 1.40% | 1.40% | -0.20% | |

| 13:30 | USD | Unit Labor Costs Q4 P | 1.40% | 0.90% | 2.50% | |

| 15:30 | USD | Natural Gas Storage | -123B | -201B |