US futures continued to rally as investors downplayed the spreading coronavirus disease. The disease has already killed more than 420 people in China. It has infected more than 20,438 people and is infecting about 2k of them every day. More than 160 cases have been reported in other countries. These numbers are bigger than those that occurred during the SARS outbreak when 349 deaths were reported. Meanwhile, Google’s stock declined by more than 4.5% in after-market trading as the market received weak growth numbers. The company reported an operating income of $9.3 billion, which was lower than the expected $9.9 billion. This marked the ninth time in ten quarters that the company has missed this number. The revenue of $46.1 billion was lower than the expected $46.9 billion.

The price of crude oil moved to a bear market as traders reacted to the coronavirus disease. This price is very sensitive to the strength of the global economy. A strong economy is a signal for increased demand. Also, China, the most affected country by the coronavirus, is the biggest consumer of oil. In the meantime, OPEC and its allies have been thinking about intervening, with the goal of stabilising oil prices. In a statement, the Kremlin said that President Vladimir Putin had talked to King Salman, and both sides stood ready to coordinate their actions. Any cuts would add to those negotiated during the December meeting.

The Australian dollar rose today after the country’s central bank delivered its interest rates decision. As was widely expected, the bank left interest rates unchanged at 0.75%. The bank also raised its growth forecast for the year. It expects the economy to increase by between 2.75% to 3%. This was a step up from the growth rates experienced in the past two years. The bank said that the recent fires and coronavirus would be a drag on the economy. It also said that house prices were starting to improve in Sydney and Melbourne.

AUD/USD

The AUD/USD pair has been declining after reaching a peak of 0.7030. It reached a low of 0.6677 yesterday. This was the lowest level since October last year. The pair is now trading at 0.6720, which is slightly above the 14-day exponential moving averages and along the 28-day moving averages. The price is above the dots of the Parabolic SAR while the RSI has moved from the oversold low of 22 to the current 38. The pair may continue rising on the changing sentiment from the central bank.

EUR/USD

The EUR/USD pair was relatively unchanged during the Asian session. The pair is trading at 1.1060, which is below yesterday’s high of 1.1095. The price is above the support shown in white below. The price is along the 14-day and 28-day EMA. The pair may remain at the current level ahead of the ADP jobs numbers from the US that will be released tomorrow.

XBR/USD

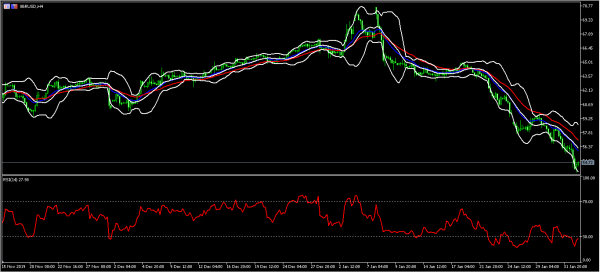

The XBR/USD pair declined to a low of 53.72. This was the lowest level since January 2019. The pair has dropped by more than 20% after reaching a high of 70.66 in January. The price is below the 14-day and 28-day exponential moving averages. It is also along the lower line of the Bollinger Bands. The price is below the oversold level of 30. The pair may continue moving lower unless OPEC+ members intervene.