Dollar trades mixed in early US session as Fed chair Janet Yellen sounds balanced in her prepared speech for the testimony to Congress. The greenback is trying to rebound against Euro at the time of writing. Though, that’s mainly due to Euro’s own weakness after yesterday’s rally. And the greenback is staying weak against Yen and Aussie. Sterling rebounds today on better than expected job data and is firm against Dollar too. Canadian Dollar is treading water as markets await BoC rate decision.

Fed Yellen sounds balanced

In her prepared remarks for the Congressional testimony, Fed chair Janet Yellen warned that there are "considerable uncertainty always attends the economic outlook," and "there is, for example, uncertainty about when — and how much — inflation will respond to tightening resource utilization." Nonetheless, for now, she maintained that the Fed "continues to expect that the evolution of the economy will warrant gradual increases in the federal funds rate over time." And, Fed should start reducing the USD 4T balance sheet this year.

Regarding the economy, Yellen said that "ongoing job gains should continue to support the growth of incomes and, therefore, consumer spending; global economic growth should support further gains in U.S. exports; and favorable financial conditions, coupled with the prospect of continued gains in domestic and foreign spending and the ongoing recovery in drilling activity, should continue to support business investment." Also, "these developments should increase resource utilization somewhat further, thereby fostering a stronger pace of wage and price increases."

Sterling rebounds on job data, Broadbent confirmed his stance

Sterling rebounds today as supported by better than expected employment data. Unemployment rate dropped to 4.5% in the quarter to May, hitting the lowest level in 42 years since 1975. Unemployment dropped 64k during the quarter to just under 1.5m. Average weekly earnings rose 1.8% 3moy in May, in line with consensus. Claimant count rose 6k in June versus expectation of 10.4k.

BoE Deputy Governor Ben Broadbent clarified his stance on monetary policy in a newspaper interview. He said that "there is reason to see the committee moving in that direction" regarding rate hike, but "there are still a lot of imponderables." And, "it is a bit tricky at the moment to make a decision." But overall "I am not ready to do it yet". It’s now clear that Broadbent will not vote for a rate hike in August BoE meeting.

EU Barnier: Still major differences with UK on Brexit

EU’s chief Brexit negotiator Michael Barnier warned that there are still major differences between EU and UK regarding citizens rights. And he complained that "the British position does not allow those persons concerned to continue to live their lives as they do today." Also, he emphasized that the European Court of Justice has to be the "ultimate guarantor of those rights".

Barnier also hit back at UK Foreign Secretary Boris Johnson’s comment that EU could "go whistle" over the demand regarding the divorce bill. Barnier said that "I’m no hearing any whistling, just the clock ticking". He reiterated that "it’s not an exit bill, it is not a ransom" and, "we won’t ask for anything else than what the UK has committed to as a member."

Australian consumer confidence improved

Australia Westpac consumer confidence snapped three months of decline and rose 0.4% in July. However, Westpac noted that "this is the eighth consecutive month where the Index has printed below 100 indicating that pessimists continue to outnumber optimists. The Index is not sending encouraging signals about the outlook for consumer spending." Meanwhile, they expect RBA to be on hold "throughout the remainder of 2017 and 2018". And, "a cautious consumer; a slowing housing market; and a weakening in the labour market with limited prospects of any boost to wages growth all point to another year of steady policy".

Subdued Inflation Facilitates PBOC’s Monetary Policy

The set of June data released so far has pointed to a steady growth trend in China, the world’s second largest economy. Released earlier in the week, headline CPI stayed unchanged at 1.5%yoy in June, shy of consensus of 1.6%. Persistently soft food price (on deflation) continued to put downward pressure on the headline reading. For instance, pork plummeted -16.7 and egg price fell -9.3%.PPI, upstream price levels, steadied at 5.5% in June, in line with expectations. Subdued inflation offers the government room to maintain its targeted tightening measures, focusing on cracking down overheating asset prices. Yet, soft PPI suggested that growth in industrial profits would be limited. More in China’s Watch: Subdued Inflation Facilitates PBOC’s Monetary Policy.

USD/JPY Mid-Day Outlook

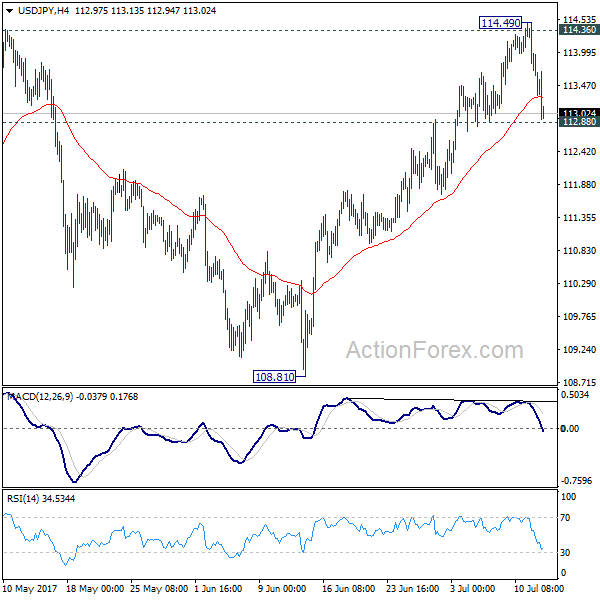

Daily Pivots: (S1) 113.60; (P) 114.05; (R1) 114.38; More…

Intraday bias in USD/JPY remains neutral with focus on 112.88 minor support. Firm break there will argue that rebound from 108.81 has completed at 114.49 after being rejected by 114.36 key near term resistance. That would also argue that the correction from 118.65 is still in progress. In such case, intraday bias will be turned back to the downside for 55 day EMA (now at 111.94). On the upside, decisive break of 114.36 resistance will confirm that corrective pull back from 118.65 has completed at 108.12. In that case, further rally would be seen to retest 118.65.

In the bigger picture, the corrective structure of the fall from 118.65 suggests that rise from 98.97 is not completed yet. Break of 118.65 will target a test on 125.85 high. At this point, it’s uncertain whether rise from 98.97 is resuming the long term up trend from 75.56, or it’s a leg in the consolidation from 125.85. Hence, we’ll be cautious on topping as it approaches 125.85.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Jun | 2.10% | 2.10% | 2.10% | |

| 0:30 | AUD | Westpac Consumer Confidence Jul | 0.40% | -1.80% | ||

| 4:30 | JPY | Tertiary Industry Index M/M May | -0.10% | -0.60% | 1.20% | 1.40% |

| 8:30 | GBP | Jobless Claims Change Jun | 6.0K | 10.4K | 7.3K | |

| 8:30 | GBP | Claimant Count Rate Jun | 2.30% | 2.30% | ||

| 8:30 | GBP | ILO Unemployment Rate 3M May | 4.50% | 4.60% | 4.60% | |

| 8:30 | GBP | Average Weekly Earnings 3M/Y May | 1.80% | 1.80% | 2.10% | |

| 9:00 | EUR | Eurozone Industrial Production M/M May | 1.30% | 1.00% | 0.50% | 0.30% |

| 14:00 | CAD | BoC Rate Decision | 0.75% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | -6.3M | |||

| 15:15 | CAD | BoC Press Conference |