Euro surged broadly overnight, with the help from selloff in Sterling and then Dollar. Strength in the common currency carries on in Asia session today. Fed Governor Lael Brainard’s cautious comments regarding rate hike is seen a a factor triggering the decline in the greenback. Fed chair Janet Yellen’s testimony to Congress today will be the key to decide whether the greenback will suffer more selling. Meanwhile, Sterling tumbled as markets continued to price out a near term BoE hike. BoE Deputy Governor Ben Broadbent’s lack of comments on interest rates was taken as a sign of neutral stance. Meanwhile, Canadian Dollar is staying in range against Dollar as markets are awaiting the highly anticipated BoC rate hike.

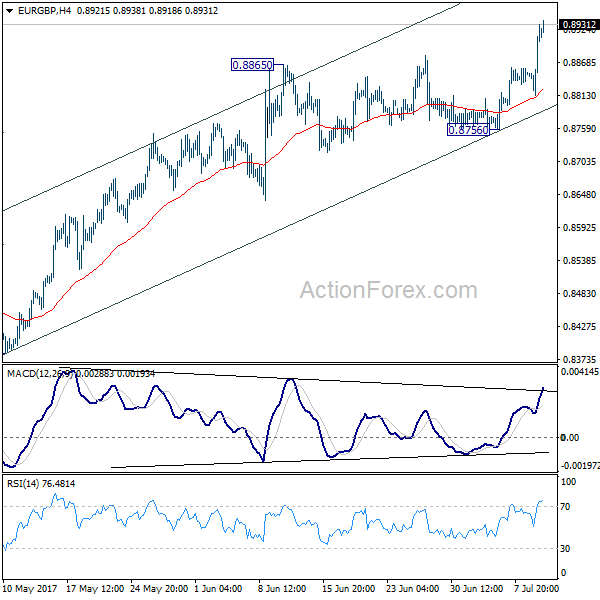

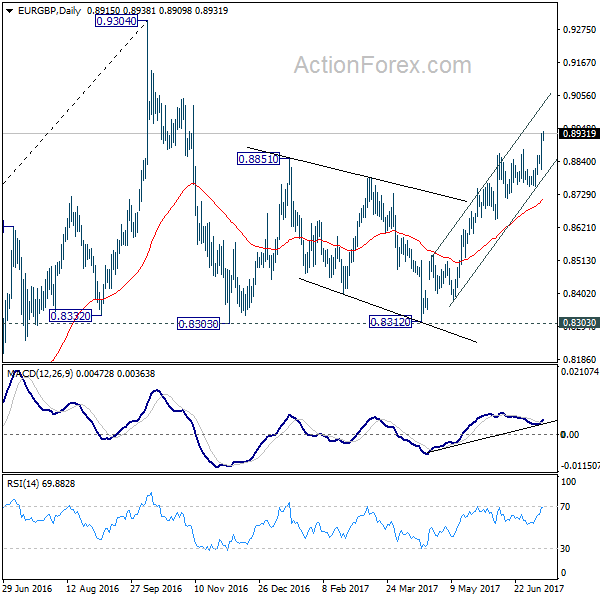

Technically, near term outlook in Dollar worsen mildly with EUR/USD taking out 1.1444 resistance firmly while USD/JPY was rejected from 114.36 key resistance. AUD/USD’ s break of 0.7643 minor resistance today also suggests further upside to retest 0.7711 resistance. Meanwhile, EUR/GBP’s break of 0.8879 resistance now suggests that recent rise from 0.8312 is resuming for 0.9304 high. GBP/JPY’s break of 146.03 minor support also signals rejection from 148 handle again and near term reversal.

Fed Brainard: Not much to do to move rate to neutral level

Fed Governor Lael Brainard sounded cautious over further interest rate hike. She noted that "I will want to monitor inflation developments carefully, and to move cautiously on further increases in the federal funds rate, so as to help guide inflation back up around our symmetric target." And, "the neutral level of the federal funds rate is likely to remain close to zero in real terms over the medium term". She pointed out that "if that is the case, we would not have much more additional work to do on moving to a neutral stance." Nonetheless, she sounded more supportive to shrinking the balance sheet and said that "if the data continue to confirm a strong labor market and firming economic activity, I believe it would be appropriate soon to commence the gradual and predictable process of allowing the balance sheet to run off,"

Euro supported by ECB expectations

Euro surges as lifted by buying in EUR/GBP and against Dollar. The common currency is also firmly supported by expectation of ECB stimulus exit. It’s generally expected that based on improving economic and inflation outlook, the central bank will announce some sort of tapering plan in September or October. Meanwhile, forward Eonia bank-to-bank rates are implying a 10 bp hike in ECB’s -0.40% deposit rate by next July. Some economists noted that it’s just a very sluggish tightening cycle that markets are pricing in. But it should still be noted that there wasn’t such expectations a few months ago before the easing of political risks in Eurozone. Euro will continue to lend support from such expectations, in particular, if underlying inflation reading accelerates.

Australian consumer confidence improved

Australia Westpac consumer confidence snapped three months of decline and rose 0.4% in July. However, Westpac noted that "this is the eighth consecutive month where the Index has printed below 100 indicating that pessimists continue to outnumber optimists. The Index is not sending encouraging signals about the outlook for consumer spending." Meanwhile, they expect RBA to be on hold "throughout the remainder of 2017 and 2018". And, "a cautious consumer; a slowing housing market; and a weakening in the labour market with limited prospects of any boost to wages growth all point to another year of steady policy".

Canadian Dollar vulnerable on a neutral BoC hike

Canadian Dollar’s place as the strongest major currency was overtaken by Euro ahead of the highly anticipated rate hike. BoC is generally expected to raise benchmark interest rate by 25bps to 0.75% today. Recent hawkish comments from BoC governor Stephen Poloz and solid economic data has already set the stage for it. But as we pointed out before, the Loonie could be vulnerable to a set back if BoC indicates that it’s a one off move, rather than the start of a "cycle".

Judging from the price actions in EUR/CAD, a post BoC pull back in Canadian Dollar is a possible scenario. The decline in EUR/CAD from 1.5257 is so far having a corrective structure. It’s also held above 1.4597 resistance turned support. A break of 1.4977 resistance will signal the completion of such decline and bring retest of 1.5257 high. And in that case, EUR/CAD could indeed be resuming the rally from 1.3782 towards 1.6103 high. On the other hand, firm break of 1.4597 will put 1.3782/4051 support zone into focus.

On the data front, Japan domestic CGPI rose 2.1% yoy in June. Australia Westpac consumer confidence rose 0.4% in July. UK job data will be the main focus in European session. Eurozone will release industrial production too.

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8848; (P) 0.8890; (R1) 0.8966; More

EUR/GBP’s strong break of 0.8879 resistance indicates that rise from 0.8312 has resumed. Intraday bias is back on the upside. Further rally would now be seen to retest 0.9304 high. At this point, there is no clear sign of up trend resumption yet. Hence, we’ll be cautious on strong resistance from 0.9304 to bring near term reversal. Nonetheless, for now, break of 0.8756 support is needed to indicate short term topping. Otherwise, outlook will stay bullish in case of retreat.

In the bigger picture, price actions from 0.9304 are viewed as a medium term corrective pattern. It’s uncertain whether it is finished yet. But in case of another fall, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside and bring rebound. Whole up trend from 0.6935 is expected to resume after consolidation from 0.9304 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Jun | 2.10% | 2.10% | 2.10% | |

| 0:30 | AUD | Westpac Consumer Confidence Jul | 0.40% | -1.80% | ||

| 4:30 | JPY | Tertiary Industry Index M/M May | -0.60% | 1.20% | ||

| 8:30 | GBP | Jobless Claims Change Jun | 10.4K | 7.3k | ||

| 8:30 | GBP | Claimant Count Rate Jun | 2.30% | |||

| 8:30 | GBP | ILO Unemployment Rate 3M May | 4.60% | 4.60% | ||

| 8:30 | GBP | Average Weekly Earnings 3M/Y May | 1.80% | 2.10% | ||

| 9:00 | EUR | Eurozone Industrial Production M/M May | 1.00% | 0.50% | ||

| 14:00 | CAD | BoC Rate Decision | 0.75% | 0.50% | ||

| 14:30 | USD | Crude Oil Inventories | -6.3M | |||

| 15:15 | CAD | BoC Press Conference |