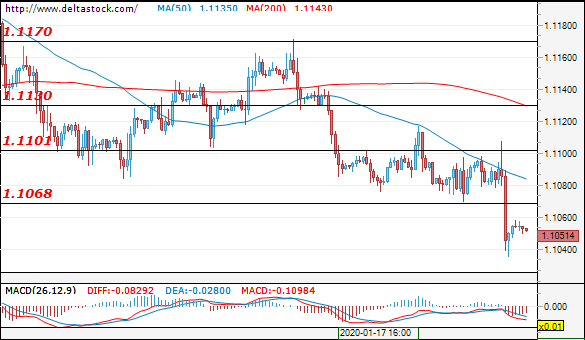

EUR/USD

Current level – 1.1051

After ECB’s decision to keep monetary policy unchanged, the euro slid against the dollar and found support around 1.1040. The downtrend is still in force but, before the price tries to target 1.0980, we should see a retracement that would probably remain limited below 1.1080. Today substantial moves can be expected around the release of the preliminary manufacturing and services PMIs (09:00 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1070 | 1.1130 | 1.1040 | 1.0980 |

| 1.1100 | 1.1170 | 1.1000 | 1.0980 |

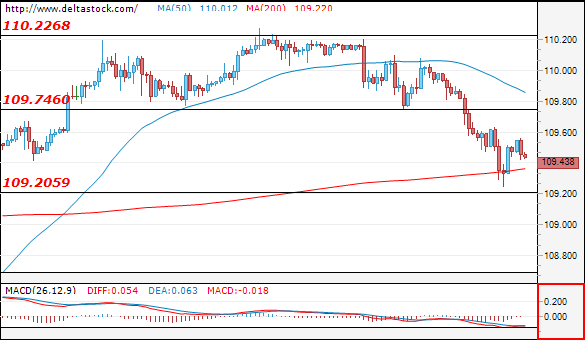

USD/JPY

Current level – 109.43

The uptrend here lost a bit of momentum and now the pair is trading a little under the resistance zone 109.55-109.75. Intraday support is at 109.20 and the support from the bigger time frames is at 108.80. The drop from the last days can be considered as a retracement and after its completion, we should see a rise towards 110.20 and 110.65 in addition

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 109.55 | 110.22 | 109.20 | 108.80 |

| 109.75 | 111.65 | 109.20 | 107.90 |

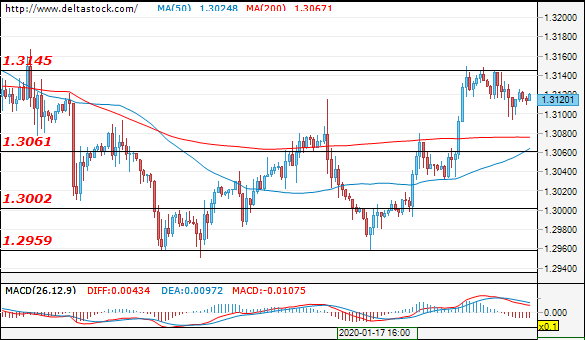

GBP/USD

Current level – 1.3120

The consolidation that is developing since the end of last year looks completed and a test of the resistance at 1.3260 is in the scope. The main support for the swing is 1.3057 and the intraday one is at 1.3100. Traders will monitor today’s data on preliminary manufacturing and services PMI for the UK (09:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3145 | 1.3210 | 1.3060 | 1.2960 |

| 1.3210 | 1.3260 | 1.3000 | 1.2790 |