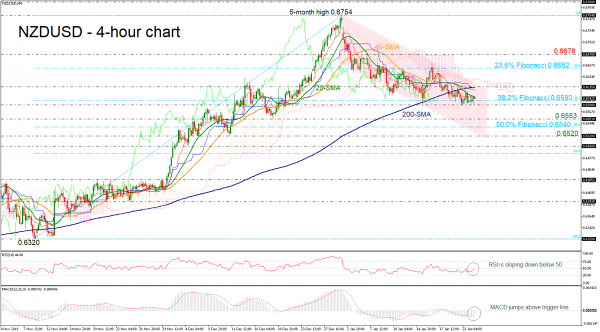

NZDUSD has been developing within a downward sloping channel over the last three weeks, remaining slightly below the short- and long-term moving averages. The price is in a downward correction move and more losses are expected if it fails to overcome the 0.6615 resistance level. The RSI is pointing slightly down in the negative territory, however, the MACD is still standing above the trigger line in the near term.

Immediate support is coming from the 38.2% Fibonacci retracement level of the upleg from 0.6320 to 0.6754 near 0.6590, before touching the 0.6580 region, taken from the latest lows. Clearing this critical zone, which has held since December 19, the price could hit 0.6553.

In the event of an upside retracement and a close above the 200-SMA at 0.6615, the door could open for the 23.6% Fibonacci of 0.6652. More gains could lead the pair until the 0.6678 resistance, registered on January 6.

In brief, NZDUSD is in bearish correction mode in the very short-term timeframe of the bullish picture in the long-term.