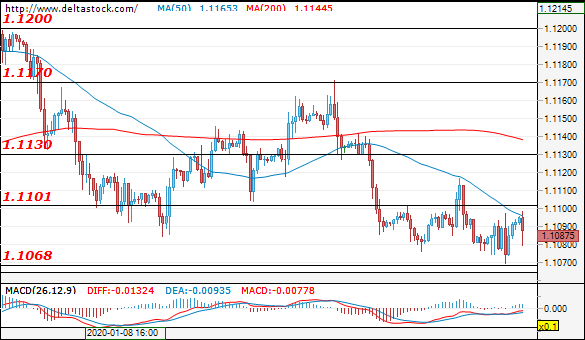

EUR/USD

Current level – 1.1087

The sentiment remains negative as the pair is expected to go for yet another test of the key support at 1.1068. A possible breakthrough at this level would pave the way towards the next key support at 1.0980. Higher volatility is expected around 12:45 GMT time when the ECB interest rate decision is to be announced and during Lagard’s press conference (13:30 GMT).

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.1100 | 1.1170 | 1.1080 | 1.1030 |

| 1.1130 | 1.1200 | 1.1068 | 1.0980 |

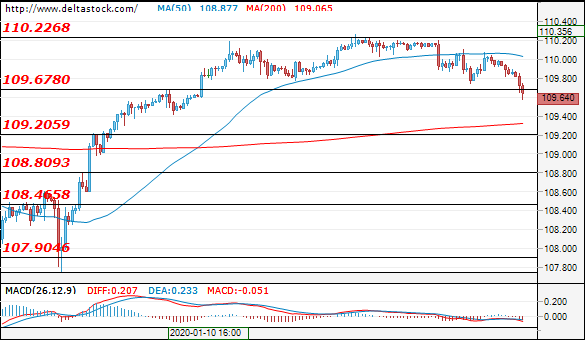

USD/JPY

Current level – 109.64

The currency pair managed to break the support zone around 109.60-109.65, but at the time of writing, the price is just below that level and the breakthrough is still to be confirmed. If the price stays below the aforementioned level, then the expectations would be for a prolonged correction phase and a test of the next support at 109.20. In the opposite direction, the first resistance lies at 110.20

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 110.20 | 110.65 | 109.70 | 108.80 |

| 110.65 | 111.00 | 109.20 | 107.90 |

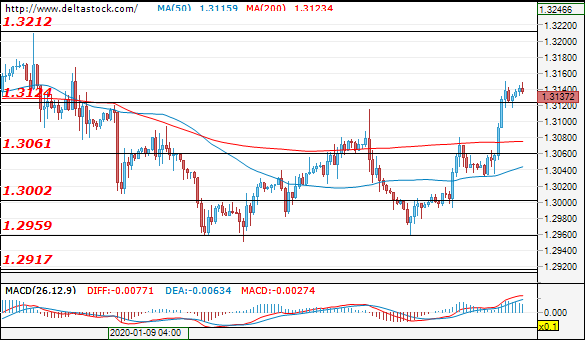

GBP/USD

Current level – 1.3137

The pair continues its upward movement which started at the beginning of the week, and consequently breached above the resistance levels at 1.3080 and 1.3125. If the price holds above 1.3125, the bullish momentum would remain intact and a test of 1.3200 would be the most likely scenario. If the pair fails to hold above 1.3125, a retracement towards the support at 1.3060 could occur.

| Resistance | Support | ||

| intraday | intraweek | intraday | intraweek |

| 1.3125 | 1.3210 | 1.3060 | 1.2915 |

| 1.3210 | 1.3260 | 1.3000 | 1.2790 |