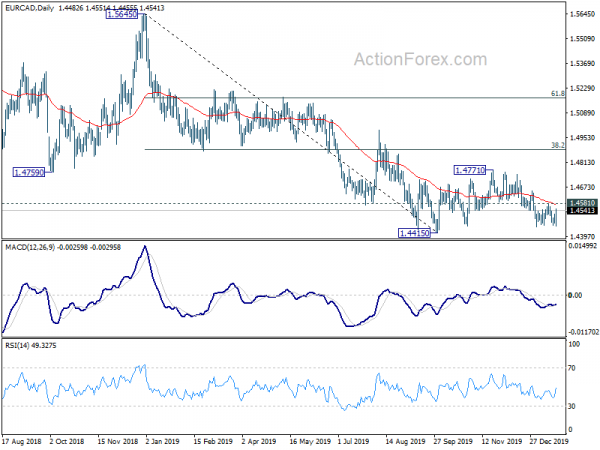

Canadian Dollar turned from being one of the strongest after CPI, to the weakest after dovish BoC. In short, BoC left the option of rate cut open. It noted in the statement “Governing Council will be watching closely to see if the recent slowdown in growth is more persistent than forecast.”

However, outlook in Canadian dollar is not overwhelmingly bearish, except probably against Dollar only, despite today’s sharp fall.

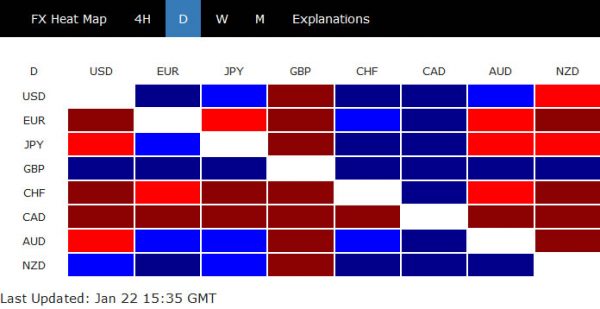

USD/CAD’s development now argues that correction from 1.3664 might have completed as a triangle at 1.2951, on bullish convergence condition in daily MACD. Sustained trading above 55 day EMA will solidify this case and target 1.3327 resistance for confirmation.

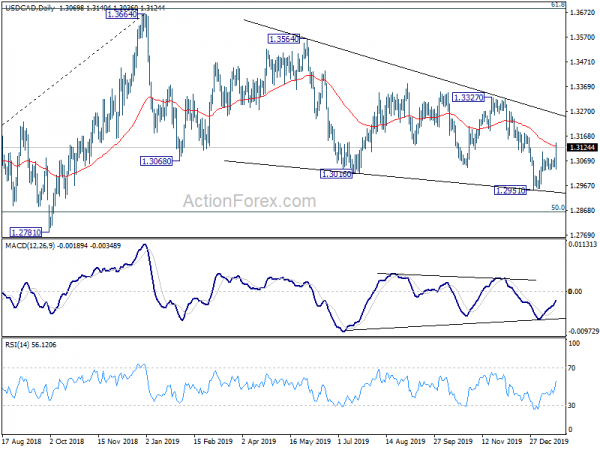

The case is building up for CAD/JPY that rise from 78.50 has completed with three waves up to 84.56, after hitting 61.8% retracement of 78.50 to 83.55 from 81.28 at 84.40. But 82.80 support is needed to trigger near term bearishness first. Otherwise, further rise could still be seen.

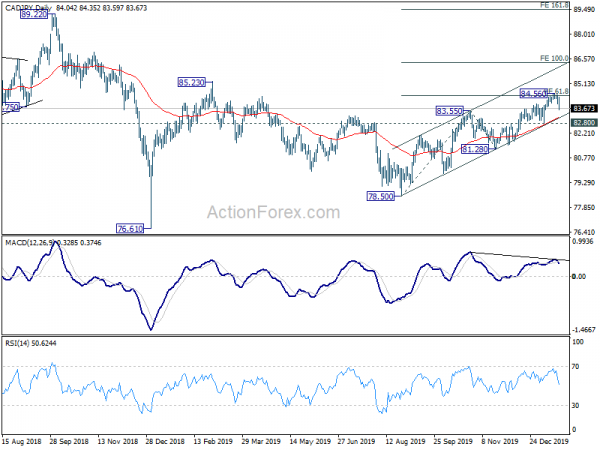

Despite the today’s rebound EUR/CAD is held below 1.4581 near term resistance so far. There is no indication of short term bottoming yet. And, even if 1.4581 is taken out, that could mean EUR/CAD is in the third leg of consolidation pattern from 1.4415. That is, larger down trend will remain in tact in that case.

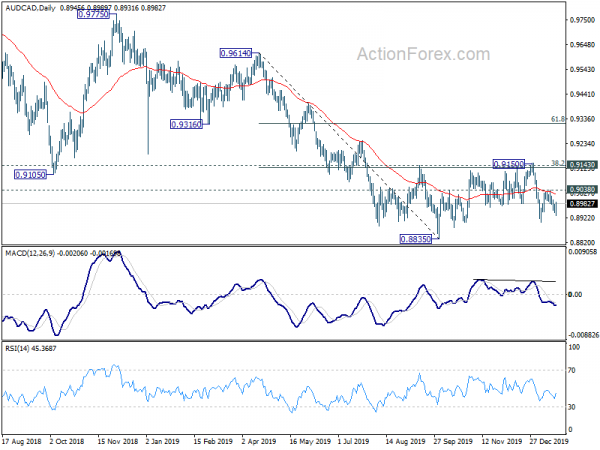

AUD/CAD is also staying below 0.9038 resistance. Fall from 0.9150 is in favor to extend to retest 0.8835 low. For now, even in case of another fall, break of 0.8835 is not anticipated. Overall, consolidation form 0.8835 will likely extend further.